Every dollar matters for startups. It's what allows creative ideas to transform from concept to reality. Unfortunately, it's also the leading cause of failure, as statistics show.

For instance, a 2021 CB Insights report on 111 startups revealed that 38% failed due to insufficient funds.

A more recent statistic by Failory based on interviews with over 80 startups also indicates that 16% failed due to financial issues.

In this article:

- 3 Key Reasons Startups Need Multiple Bank Accounts

- How a Startup Can Use Multiple Accounts Effectively

- Strategies to Minimize Fees When Using Multiple Business Bank Accounts

To avoid such problems, it’s best to have the right banking strategies in place early on.

Taking it a step further, maintaining multiple business bank accounts can be an even smarter move.

This article explains why startups should consider having more than one business bank account, how to use it effectively, and tips on reducing fees while keeping several accounts.

3 Key Reasons Startups Need Multiple Business Bank Accounts

Here are three primary reasons why having multiple business bank accounts is essential:

1. Enhanced financial transparency

If you use one account for all your transactions, you'll likely be sifting through months of transaction records to identify deductible expenses and income sources.

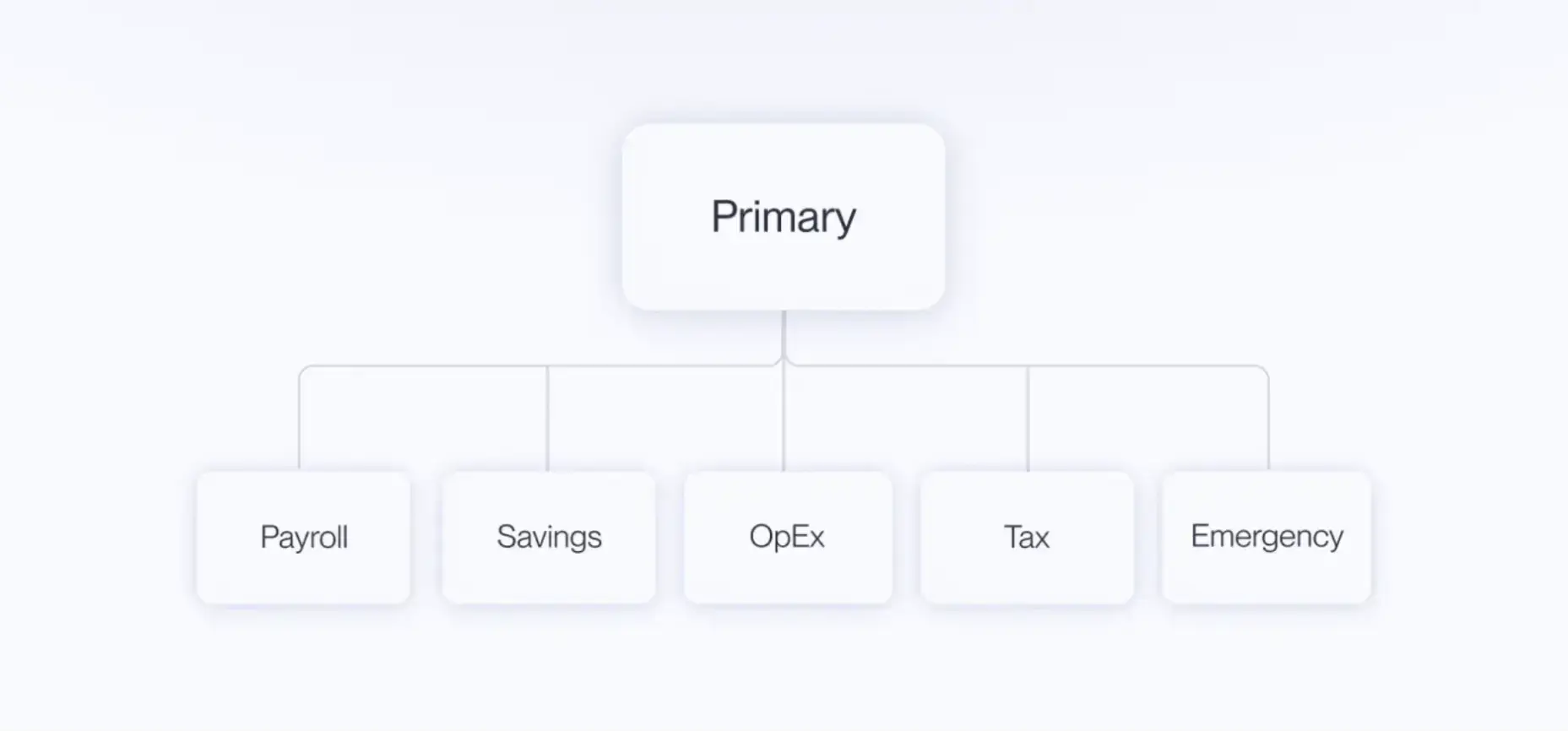

Alternatively, with multiple business accounts, you can segregate funds for operating expenses, payroll, savings, and capital raises.

This enhances financial transparency, which benefits startups in several areas, including:

- Improved budget planning through a clearer picture of cash flow patterns. The faster you can see where money comes from and goes, the quicker you can see expenses you can cut.

- Startup founders often overvalue their business ideas—sometimes by as high as 255%—but the better the financial record-keeping, the more realistic the startup valuation according to 409a valuation services. This also helps businesses make informed decisions regarding growth strategies.

- Streamlined tax matters, considering diverse obligations such as income tax, sales tax, or payroll tax.

- Transparent record-keeping may enhance a startup’s chances of getting a loan or attracting investments.

- If you have multiple products and utilize different accounts, you may be able to achieve a better, easier, and quicker assessment of the profitability of specific products or services.

Moreover, for international startups dealing with multiple currencies, having only one single-currency account can be challenging due to exchange rate fluctuations.

To optimize fund management and profits, consider opening multiple business accounts for different currencies or using a multi-currency account.

2. Better cash flow for uninterrupted operations

You may wake up to a frozen business account for several reasons.

This might be because you made large purchases that differed from your usual spending patterns, engaged in transfers to or from foreign accounts, completed transactions from unfamiliar locations, or simply experienced system glitches.

Resolving such issues with the bank can be uncertain and time-consuming.

The time it takes to unfreeze accounts varies; on average, it takes a few days, and in more complicated cases, it can even take weeks or months.

For instance, being unable to access funds may cause you to miss a payment to your international suppliers or partners if you cannot accept or receive international payments.

This can lead to further delays before suppliers resume shipping. In today's fast-paced environment, you want to optimize your supply chain rather than face such interruptions.

Spreading your funds across multiple accounts ensures uninterrupted operations because you can access money from other accounts if one becomes unavailable.

3. Diversifying risks

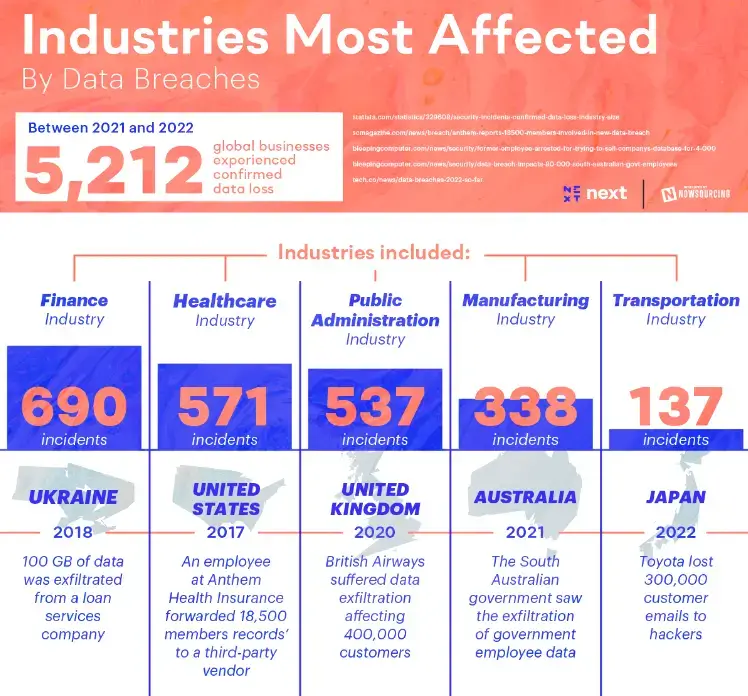

47% of financial data breaches were aimed at banks, and the financial industry experienced the highest number of data breaches in 2023.

Relying solely on a single business account poses risks if that account were to be breached, compromised, or experience a rare bank failure.

These risks are reduced by diversifying across multiple accounts at different banks.

Moreover, spreading finances across various start-up business bank accounts increases the number of insured assets, thereby enhancing financial security.

How a Startup Can Use Multiple Accounts Effectively

For a startup operating with multiple bank accounts, effective management is crucial for financial health.

A disjointed approach can result in unnecessary fees and poor visibility into cash flows.

Below are key strategies for effective management.

Define specific roles for each account

Before opening a new account, ensure it serves a distinct purpose.

Common objectives include income collection, operating expenses, tax obligations, salary disbursements, and emergency funds.

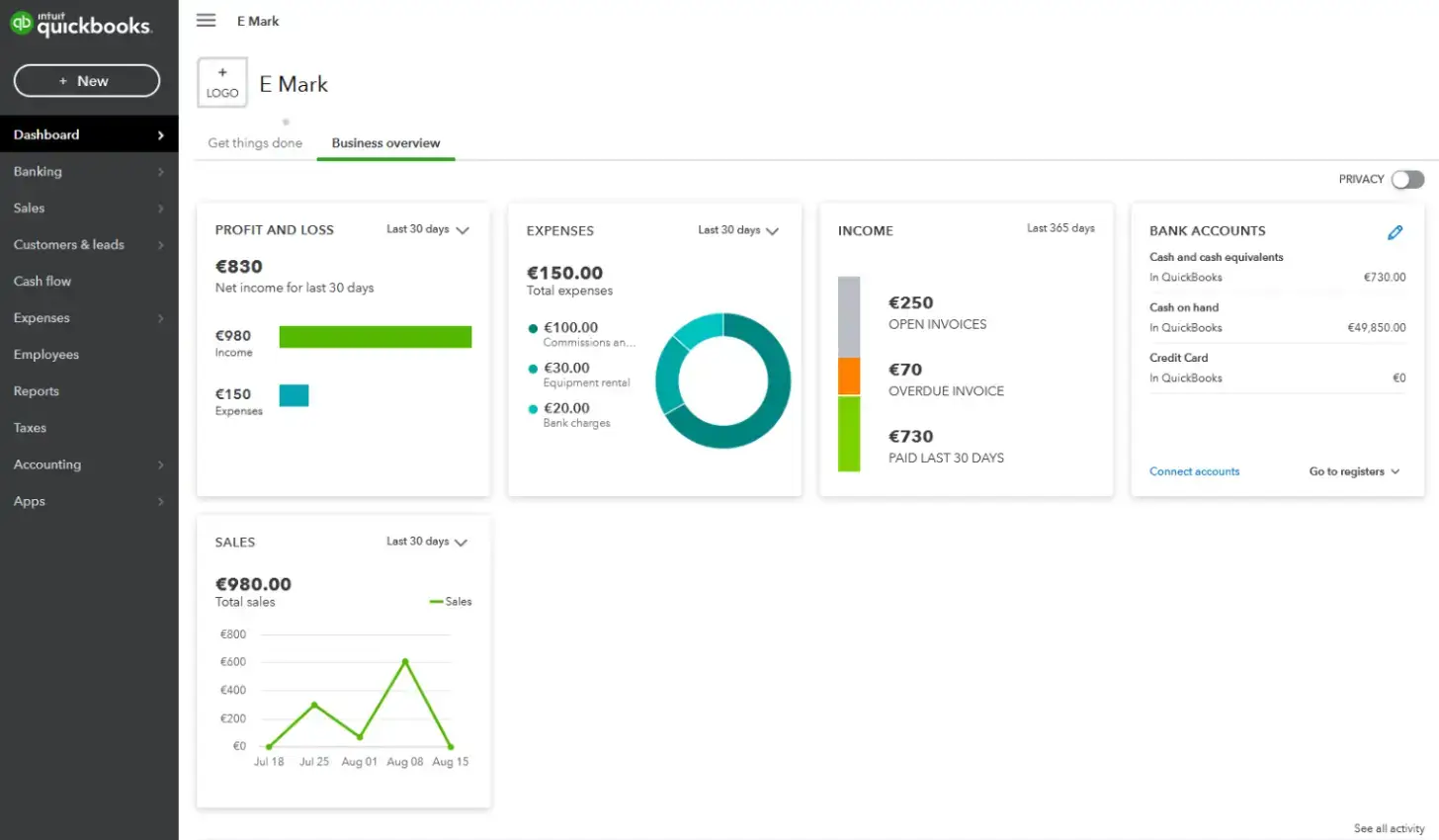

Track transactions

It's crucial to track dedicated funds for each account based on its defined purpose.

These tools allow you to assign transactions to specific accounts, categorize expenses, and generate insightful reports.

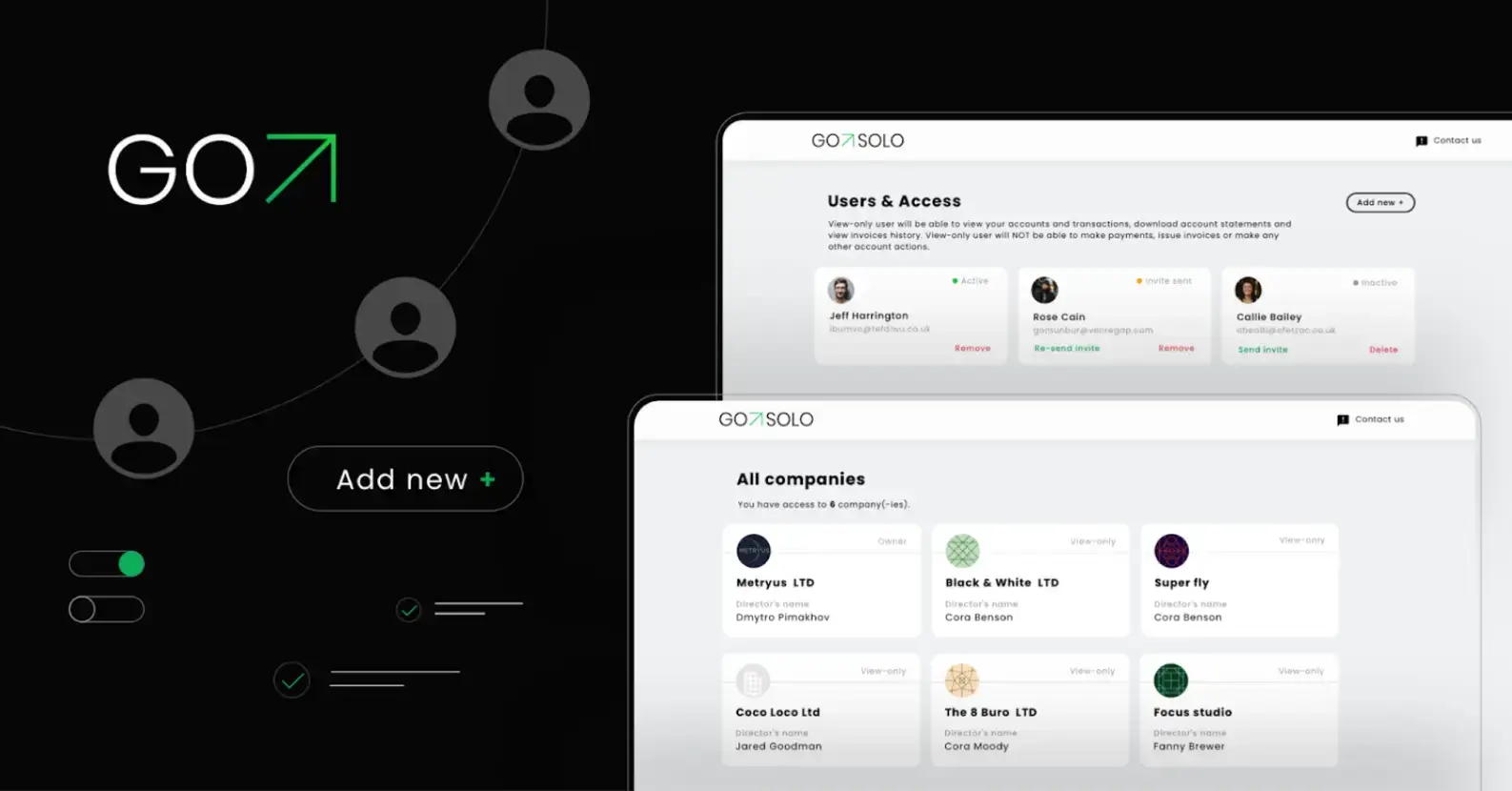

Periodically review account access

If multiple people handle your business accounts, assign clear responsibilities and periodically review access to boost security and prevent unauthorized activities.

Strategies to Minimize Fees When Using Multiple Business Bank Accounts

Some may hesitate to use multiple accounts due to potential costs; however, the benefits often outweigh the expenses.

Nevertheless, exploring ways to minimize fees is wise, especially if you own a low-cost startup.

Choosing the right financial institution

Examine the expenses of a bank or financial service provider, particularly account fees, monthly charges, and minimum balance requirements.

Ensure these expenses won’t harm profitability. Online banks and neobanks often provide low-fee or free business checking accounts.

Exploring fee waiver options

Many banks waive monthly service fees if certain conditions are met, such as maintaining a minimum balance or using their business debit/credit card.

Understanding these requirements can help you avoid extra charges.

Leveraging account features

Make use of account perks such as ATM fee reimbursements, high-interest rates, and free checks.

One strategy is using a low-minimum-balance account for expenses while directing long-term funds to a high-interest savings account.

Stay informed

Keeping track of statements, receipts, and invoices helps determine whether multiple accounts are beneficial or costly.

Final Words

Managing multiple business bank accounts offers startups advantages in financial transparency, operational continuity, and reduced risk.

This approach improves financial decision-making, strengthens cash flow stability, and safeguards company funds.

Selecting the right financial institutions, understanding fee waivers, and leveraging account features can further optimize your multi-account financial strategy.