The rise of digital banking and online transactions has made financial services more accessible than ever. From mobile banking apps to credit union websites, consumers can manage their money with just a few clicks.

Still, this simplicity of use can lead to potential cybersecurity dangers, which many people fail to notice. Cybercriminals are always finding new ways to exploit vulnerabilities in online finance.

Is online banking safe? The short answer is yes. However, to maintain complete financial security, you need to understand the most common cyber threats and how to protect yourself.

This article examines significant risks, their possible effects, and optimal strategies for maintaining safety.

Article Shortcuts:

- Common Cyber Threats in Online Finance

- The Impact on Consumers

- Best Practices to Stay Safe

- The Role of Financial Institutions in Consumer Protection

- FAQs

Source: Pexels

Common Cyber Threats in Online Finance

-

Phishing attacks

Phishing remains a significant cyber threat in online finance. Attackers send misleading emails or messages, pretending they come from authentic financial institutions.

These messages often contain links to fake websites designed to collect login information or personal details. Once an attacker gains access, they can conduct unauthorized transactions or steal confidential financial data.

Many phishing attempts appear very advanced, making it difficult to tell them from real messages. Cybercriminals might use words that show urgency, like "your account is in danger."

This causes you to act quickly without verifying the source of the message. Always check URLs and avoid clicking suspicious links in emails or text messages.

-

Malware and ransomware

Malware is destructive software that can access devices and steal private data. Ransomware, a specific type of malware, restricts users from accessing their files or systems until a ransom is paid.

Cybercriminals often use malware to access credit card details, banking credentials, or other personal information.

Users may unwittingly download malware from compromised websites, dangerous email attachments, or fake financial apps.

Frequent software and antivirus updates help reduce risk. Users should also avoid downloading files from unknown sources and verify the validity of banking apps before installing them.

-

Data breaches

Cybercriminals' main targets are financial institutions and online payment systems, which store enormous volumes of user data. Sensitive financial data revealed in a data breach might lead to identity theft and wrongful transactions.

Notwithstanding your bank's strong security policies, you will still be exposed to risk should breaches occur at outside services connected to your accounts.

Consumers should be cautious about where they store their financial information online. Using diverse passwords for different money-related services and turning on multi-factor authentication (MFA) can lessen any damage if a breach happens.

-

Identity theft

Identity theft occurs when cybercriminals steal personal information, such as Social Security numbers, banking details, or credit card information, to impersonate victims and conduct fraudulent activities.

This can lead to unauthorized loans, credit card applications, and even tax fraud in your name.

Preventing identity theft requires a proactive approach. To detect suspicious transactions, regularly monitor bank statements, credit reports, and account activities.

If you suspect identity theft, report it to your financial institution and credit bureaus immediately.

-

Man-in-the-Middle (MITM) attacks

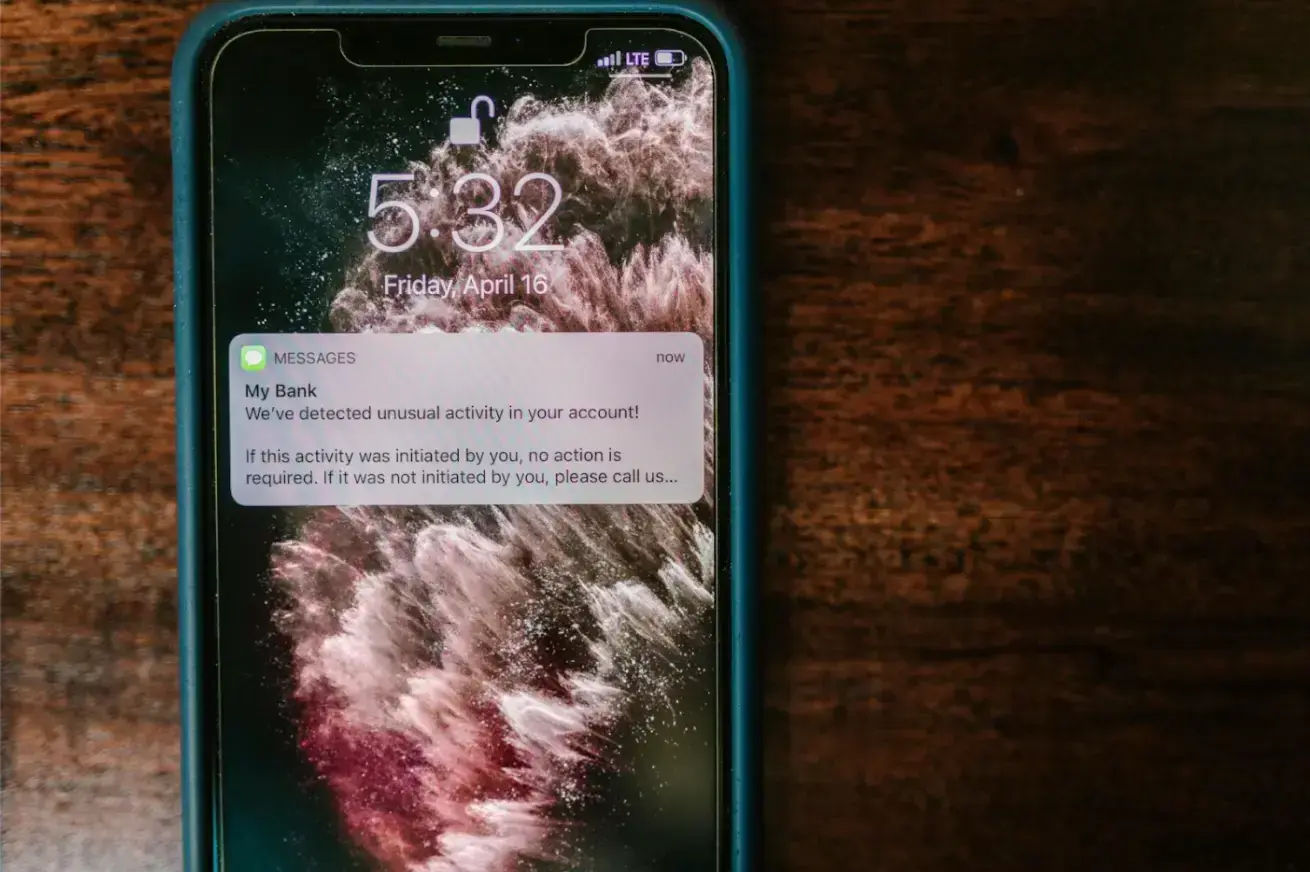

Source: Pexels

MITM attacks occur when hackers intercept information between users and financial organizations. They often occur on open public Wi-Fi networks, where hackers can seize login details, credit card numbers, or confidential financial data.

For your protection, avoid money-related activities on public Wi-Fi. Use a virtual private network (VPN) to secure your internet connection and ensure safe interactions with your financial service providers.

The Impact on Consumers

Source: Freepik

In internet banking, cyber threats can have terrible results.

One of the most immediate consequences is financial loss, as cybercriminals can access credit lines, deplete bank accounts, or make fraudulent transactions using stolen data. Recovering lost money can be challenging and time-consuming, particularly if the fraud is not reported promptly.

Beyond losing money, these risks may damage a person's credit score and financial position.

People who suffer from identity theft often have problems with loans and credit accounts that are opened without their permission using their identities. Regaining financial credibility might take several months or years, so customers need to stay aware and take preventive security actions.

Best Practices to Stay Safe

-

Using strong passwords and MFA

A strong password is the main defense against online threats. Create complicated and unique passwords for each financial account and avoid using the same passwords on multiple platforms.

MFA improves safety by requiring a second confirmation method, such as receiving a code on your mobile device or using biometric identification.

-

Recognizing and avoiding suspicious emails and links

Cybercriminals often use misleading emails or text messages to trick users and get their personal information.

Be careful with unexpected messages asking for your personal information; always confirm the sender's authenticity before clicking on any links. If you are unsure, contact your bank directly.

-

Keeping software and devices updated

Older programs may have security flaws that thieves could find use for. To lower risks, make sure your operating system, web browsers, and banking apps are routinely upgraded with the most recent security fixes.

-

Using secure Wi-Fi and VPNs for transactions

Public Wi-Fi networks can be vulnerable to cyberattacks. Do not access financial accounts while on these public networks. If necessary, use a VPN to secure your connection and enhance your safety.

-

Monitoring bank statements and credit reports regularly

To find illegal activity early on, routinely check your credit reports and bank statements. Many financial organizations provide real-time alerts for unusual behavior, therefore enabling prompt response to possible risks.

Source: Pexels

The Role of Financial Institutions in Consumer Protection

Banks and financial organizations use many security rules to protect customer data. These include methods like encrypting information, systems to detect fraud, and safe ways to confirm identities.

Banks and financial technology companies also offer protection policies against fraud; they frequently pay back their clients' money in cases of unapproved transactions.

Consumers should use secure payment methods, such as encryption-based transactions. Additionally, understanding a bank’s fraud policies can help users react appropriately in case of a security breach.

Source: Pexels

FAQs

1. What should I do if I fall victim to online financial fraud?

Contact your bank or financial organization quickly to report fraud and ensure the safety of your accounts. If identity theft occurs, inform credit agencies and consider freezing your credit to prevent further harm.

2. How can I tell if an email from my bank is legitimate?

Look for indications of phishing, such as mistakes in grammar, urgent language, or unknown sender email addresses. If you are not sure, contact your bank directly through its official website or phone number.

3. Are mobile banking apps safe to use?

Yes, but only if you download from official app stores. Make sure your banking application receives timely updates and turns on security attributes such as biometric authentication and MFA.

4. How often should I check my bank statements for suspicious activity?

It is recommended that you review your statements at least once a week and activate actual-time alerts from your bank. This will help you identify any deceitful transactions as soon as possible.

By staying informed and following best practices, consumers can protect themselves from evolving cyber threats in online finance.

Bottom Line

Cyber risks in internet banking are growing, so users must be educated and act early.

Individuals can greatly lower their risk of financial fraud by spotting common hazards, following strong security policies, and taking advantage of financial institutions' protective actions.

Maintaining awareness and prioritizing cybersecurity guarantees a better online banking experience.

Author Bio

With more than four years of experience, Dimitar Vladimiroski excels at elevating brands by crafting content that resonates with their audiences on a personal level. His innovative approach and commitment to adding value have established him as a dedicated writer who wants to connect with and educate diverse audiences through compelling content.