The investment scene remains vibrant, offering a variety of wealth-boosting opportunities. Investors are now crafting new portfolios that go beyond the usual stocks and bonds.

As we head into 2025, let's look at the most promising trends this year, emphasizing luxury assets and alternative investments.

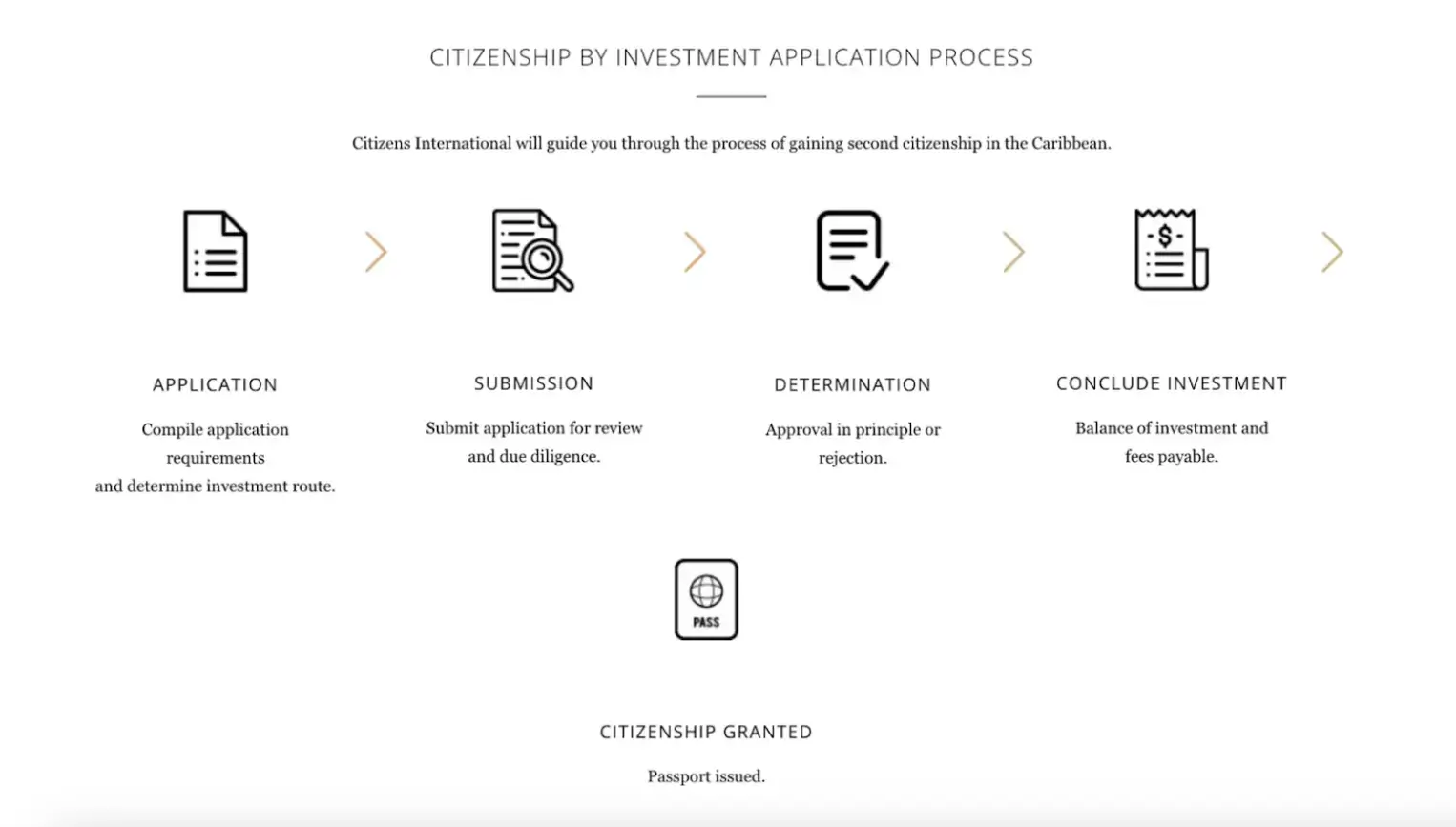

1. Citizenship by Investment Programs

Recently, the idea of investment migration gained huge traction among high-net-worth individuals. These successful investors are seeking ways to diversify their assets worldwide.

A key nuance of this approach is that it combines ROI with greater freedom of movement and appeals to the ever-increasing number of investors looking to broaden their portfolios.

Understanding the basics

Countries like Portugal, Malta, and the Caribbeans are using the second citizenship concept, qualifiable investment, and lifestyle change to attract the masses' interest.

Most of these programs require an investment between $100,000 and several million dollars and, in return, offer instant citizenship or residency perks, real estate or government bonds, and business operations.

Source: CITIZENS INTERNATIONAL

Benefits and returns

The profits come from anticipated real estate appreciation, tax savings, and enhanced global mobility.

It is appealing to brand oneself as an investor in a particular business jurisdiction while maintaining international tax-efficient structures. Government-backed programs further secure these investments.

2. Luxury Fashion Investment

This year, 2025, the alternative investment sector is experiencing a surge, and luxurious fashion investments are leading the charge.

Investors worldwide are slowly beginning to understand that fashion can serve as an asset, and for good reason. It possesses an inherent value that can yield significant returns on investment.

Source: Freepik

Market performance

To the surprise of many, the luxurious fashion market has proven to be one of the fastest-growing segments.

Over the past several years, limited edition designer handbags, especially the Hermes and Chanel-branded handbags, have appreciated brilliantly. Some rare pieces of the Hermès Birkin bag can outperform the stock market and trade up to a 29% value rise annually.

Investment strategy

Achieving profitability in the luxury fashion industry investment requires considerable market research, strong product authentication skills, and a comprehension of the brand’s story.

Investors often target classic garments from famed logos, which have a history of appreciating in value. Serious investors must build relationships with authorized dealers to hone their skills in authenticating pieces.

3. Vintage Designer Clothing

The vintage fashion market serves as a compelling blend of history and commerce.

With increasing focus on sustainability and the sheer lack of unique pieces, vintage clothing, in particular, has become more than just a style statement – it is now an investment strategy.

Historical value appreciation

In particular, avid collectors are seeking limited and collector's editions of '90s and early 2000s runway pieces, which have skyrocketed in value.

Storage and maintenance

Proper storage and preservation are essential to sustaining the value of an investment. Designer clothing is most valuable when it is in impeccable condition.

Identify all the essential factors, such as the need for climate-controlled environments or professional care services. In addition, maintenance, along with documentation of claimed provenance, dramatically improves resale value.

4. Luxury Yacht Investment

The luxury yacht market is an exceptional combination of lifestyle and leisure investment. Grandeur spending aside, buying a luxury yacht can offer personal pleasure while providing financial returns through multiple sources of cash flow.

Source: Gulf Craft

Market dynamics

Although yachts are typically viewed as depreciating assets, the luxury yacht charter market offers profit opportunities.

Investments in high-end yachts can yield significant profits through charter operations in sought-after regions such as the Mediterranean and the Caribbean.

Operational considerations

Successful yacht investment requires understanding seasonal demand, maintenance expenses, and other charter market forces.

Investors tend to collaborate with a professional management firm to enhance the return potential and reduce the operational burden. The secret is constantly investing in vessels with strong charter potential and high maintenance standards.

5. Designer Sneakers and Limited Editions

Sneaker investments witnessed a tremendous transition from mere collectors’ hobbies to a serious investment avenue.

Substantial profit opportunities are accessible in this market segment due to the booming sneaker culture and exclusive edition drops.

Source: Freepik

Market growth

As sneaker investment grows, unique collaborations and releases are highly sought after.

Secondary markets are booming for Nike and Adidas limited-edition sneakers, and even some luxury fashion brands are joining the fray. Select pieces could yield over $102 billion by 2025.

Authentication and resale

Success is simple to achieve by understanding the release pattern, maintaining impeccable shoe condition, and ensuring authentication. Specialized platforms and authentication services even help many investors ensure legitimacy and increase resale value.

6. Sustainable Fashion Ventures

The sustainable fashion industry lies at the sweet spot of profitability and social impact. It's perfect for investors looking to make a long-lasting impact while getting profits.

Innovation and growth

The focus on sustainability is rapidly increasing, pumping funds into sustainable fashion brands and technologies. In 2025, companies concentrating on new-age materials, circular fashion, and green supply chain management will benefit the most.

Impact investment potential

For investors seeking a good cause to invest in, this sector offers both strong financial returns and greater environmental impact. When you want to invest in line with the values you respect, this is a perfect choice.

7. Digital Fashion and NFTs

The shift to digital fashion is another trend altering the investment landscape, presenting new investment opportunities in virtual and blockchain fashion items.

Virtual asset evolution

Virtual fashion, especially from established luxury brands, is performing exceptionally well and generating additional profits in the metaverse and gaming spaces.

Future prospects

As the metaverse grows, there is increasing potential for investment in fashion. The convergence of blockchain technology and virtual worlds continues to open new avenues for investment in the digital world.

Investment Considerations

Other factors should be evaluated regarding their impact on short-term and long-term returns before making an investment decision in alternative assets.

In areas like DeFi smart contract development, careful consideration of risks and potential rewards is equally important to ensure sustainable growth.

Tools like APY calculators can help investors estimate potential yields more accurately, especially when comparing various asset classes or savings vehicles.

Another time-tested alternative is physical precious metals. Gold, in particular, can hedge inflation while adding a liquid, globally recognized asset to your portfolio.

When comparing formats, it’s crucial to understand how much a gold coin costs and why coins often carry higher premiums than bars due to minting, legal tender status, and collectibility.

Those premiums influence buy/sell spreads, storage and insurance choices, and your net returns.

Investors seeking flexibility may gravitate to widely recognized bullion coins, while cost-sensitive buyers might prefer larger bars with lower per-ounce premiums.

Due diligence

Instead of venturing deep into these investment trends, think about:

- Market intelligence acquisition and self-verification authentication are paramount.

- Risk mitigation via over-diversification remains crucial.

- For large investments, professional assistance becomes essential.

- Decisions require consideration of storage and maintenance expenses.

- The choices provided differ dramatically in terms of market liquidity.

Risk management

Liquidity, knowledge of market cycles, and exit strategies are essential aspects of alternative asset investments.

A thoughtful step towards successful investment is regular monitoring of the portfolio, which will help improve market understanding and ensure more favorable risk-adjusted returns.

Frequently Asked Questions (FAQ)

1. What are the top investment trends for 2025?

Key trends include citizenship-by-investment, luxury fashion assets, yacht charters, digital fashion, and sustainable fashion investments.

2. Why is citizenship by investment a good option?

It offers global mobility, tax advantages, and asset diversification, making it attractive for high-net-worth individuals.

3. How can luxury fashion be a profitable investment?

Designer handbags and vintage pieces appreciate in value over time, especially rare or limited-edition items.

4. Can investing in yachts generate income?

Yes! Luxury yacht charters in high-demand locations can provide strong rental returns.

5. Is digital fashion really a smart investment?

With the rise of the metaverse and NFTs, digital wearables are becoming a lucrative new asset class.

Conclusion

In addition to conventional financial assets, the best investments for 2025 are luxury assets in the fashion and lifestyle sectors, which offer value diversification.

However, the strategy works best when ample research, expert input, and patience are provided since these markets are nuanced.

Investing successfully in 2025 requires constructing a thoughtfully diversified portfolio with both traditional and alternative investments, along with significant liquidity and acceptable risk.

Portfolios should be reviewed and adjusted periodically to ensure a constant alignment between one’s financial goals and the dynamic market environment.

Author Bio

Sofiko Saltkhutsishvili is a content writer and a senior outreach specialist at SEO Sherpa. She enjoys conducting in-depth research on topics she writes about and shares her authentic experiences with readers. Originally from beautiful Georgia, she currently resides in its capital, Tbilisi. In her free time, you can find her exploring new cafes in the city or having a picnic with friends in a park.