Effective cash flow management positions businesses to survive market downturns and take advantage of any opportunities that may present themselves.

Maintaining sufficient cash reserves helps cover operational expenses without hastily relying on debt, which can significantly worsen your financial stability.

In this article:

For early-stage startups, especially the ones operating in highly competitive industries such as rapid delivery, this task is particularly challenging.

Various startups, such as Jokr, Gorillas, and Getir struggled and had to resort to layoffs after being unable to resolve issues in their unit economics.

In rare cases, poor cash flow management can cause even the most promising startups to close shop before the realization of their visions. This article will discuss the five practical strategies to help startups manage cash flows effectively.

Top 5 Practical Strategies to Manage Startup Cash Flow

You can effectively optimize your cash flow management by utilizing the following strategies.

1. Create a Realistic Budget Based on Your Runway

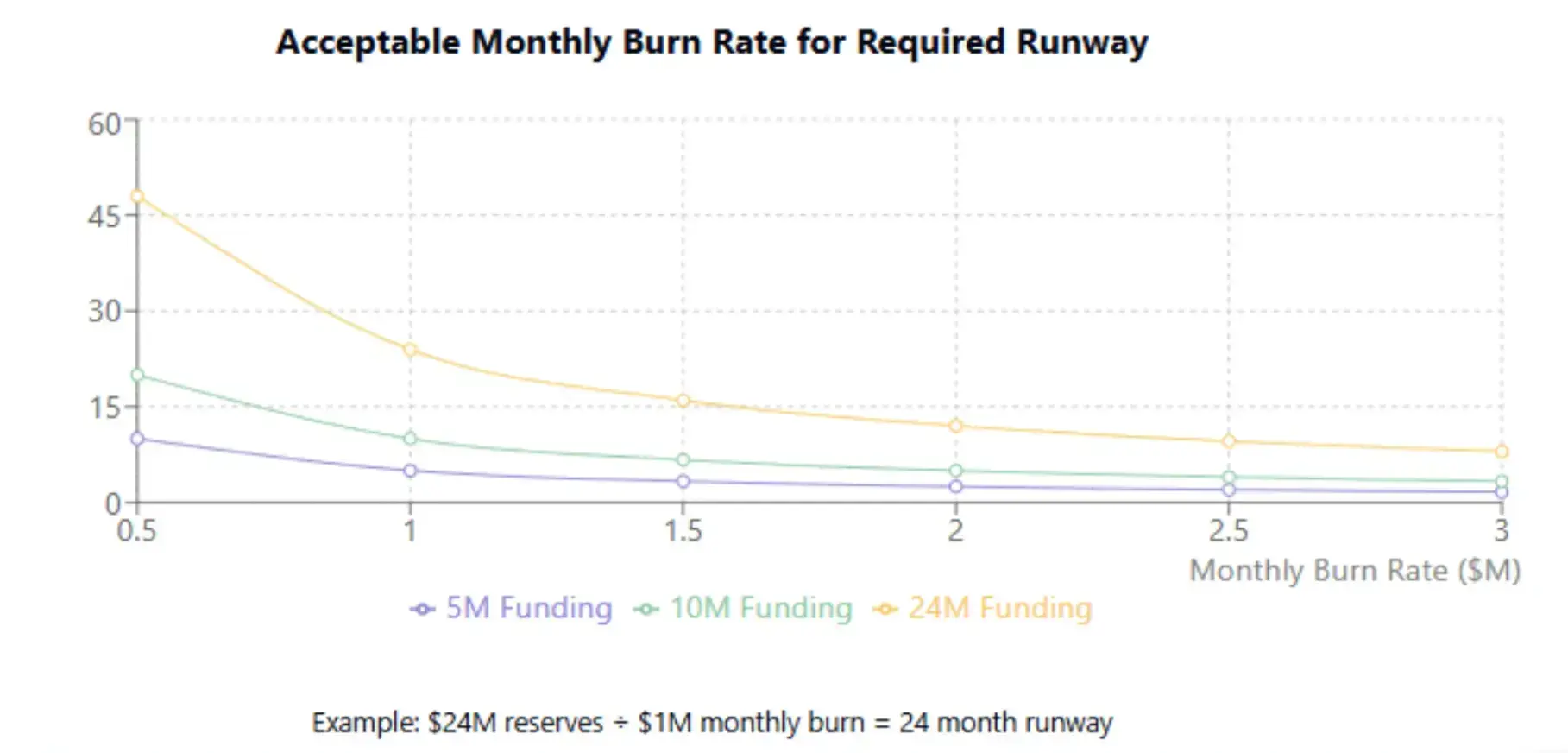

You must establish a budget based on the ideal runway length.

Suppose you have reserves of $24 million and, at the current growth rate, you need at least 2 years to scale operations and reach the next funding round. Then, your monthly net cash outflow must not exceed $1 million ($24 million ÷ 24 months).

Budgeting would also involve categorizing and ranking expenses based on how effectively they advance you toward securing your next funding round.

For instance, for an early-stage startup, marketing expenses should take a backseat to product development expenses.

You might think that better marketing brings in more businesses and reduces the burn rate. However, these expenses are unlikely to place an early-stage startup in a good light. At this stage, a startup is judged based on early traction and the product-market fit.

Conversely, at later stages, refining the product further would require extensive capital expenditure, but the benefits of such improvements could be limited. Instead, intensifying marketing efforts to demonstrate commercial viability may connect to raising funds for further product development.

2. Offer Stock-Based Compensation to Conserve Cash

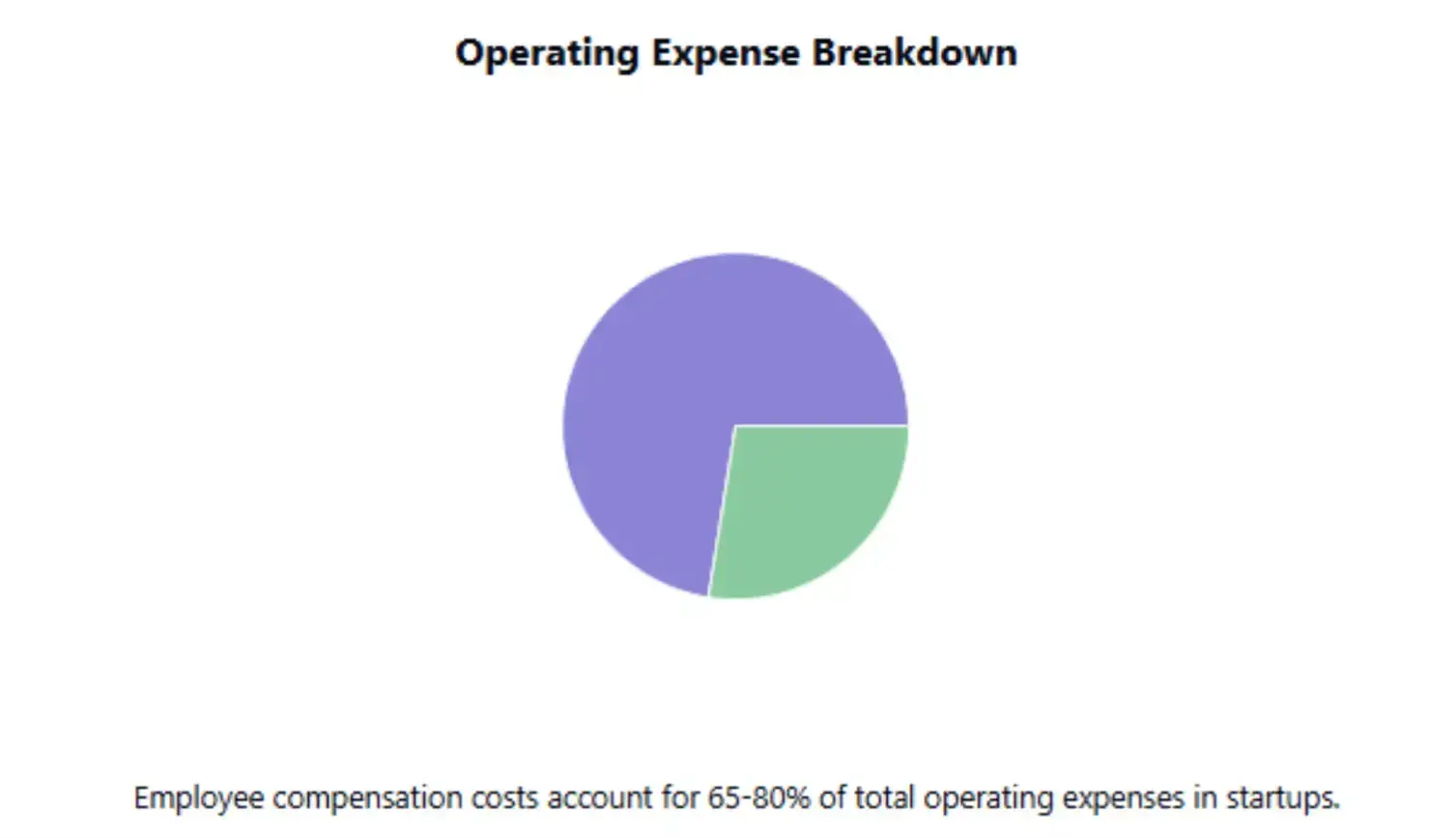

At startups, employee compensation costs account for 65% to 80% of the total operating expenses.

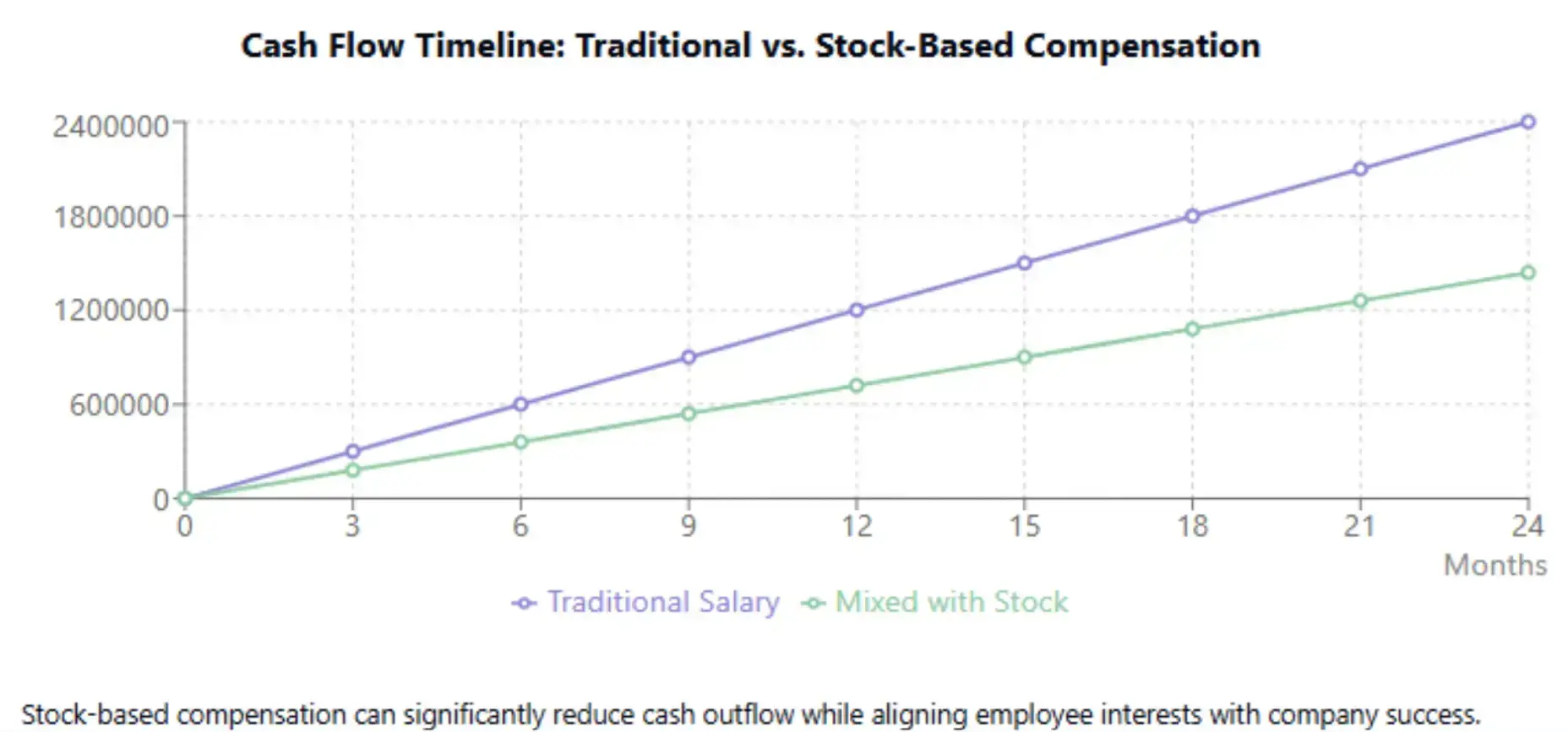

Hence, a startup’s burn rate and runway are directly related to its employee costs. One way to defer employee compensation would be to offer stock-based compensation.

Not only does this allow startups to slow their cash outflow, but it also connects the employees’ wealth with the startup’s fate.

Since the startup’s performance is linked to their own wealth creation, employees would be even more motivated to drive results.

An effective way to manage cash outflows through stock-based compensation would be to implement cliff vesting and periodic vesting strategically.

Under cliff vesting, the stock options begin vesting after a specific number of years of service. Under periodic vesting, stock options begin vesting over a certain number of years as per a set schedule.

By using both these clauses in tandem, you can ensure that equity is offered only to loyal employees and the expense is stretched over a number of years.

Thus, you would have sufficient flexibility to respond to employee requests for buybacks.

3. Optimize Credit Terms with Customers and Suppliers

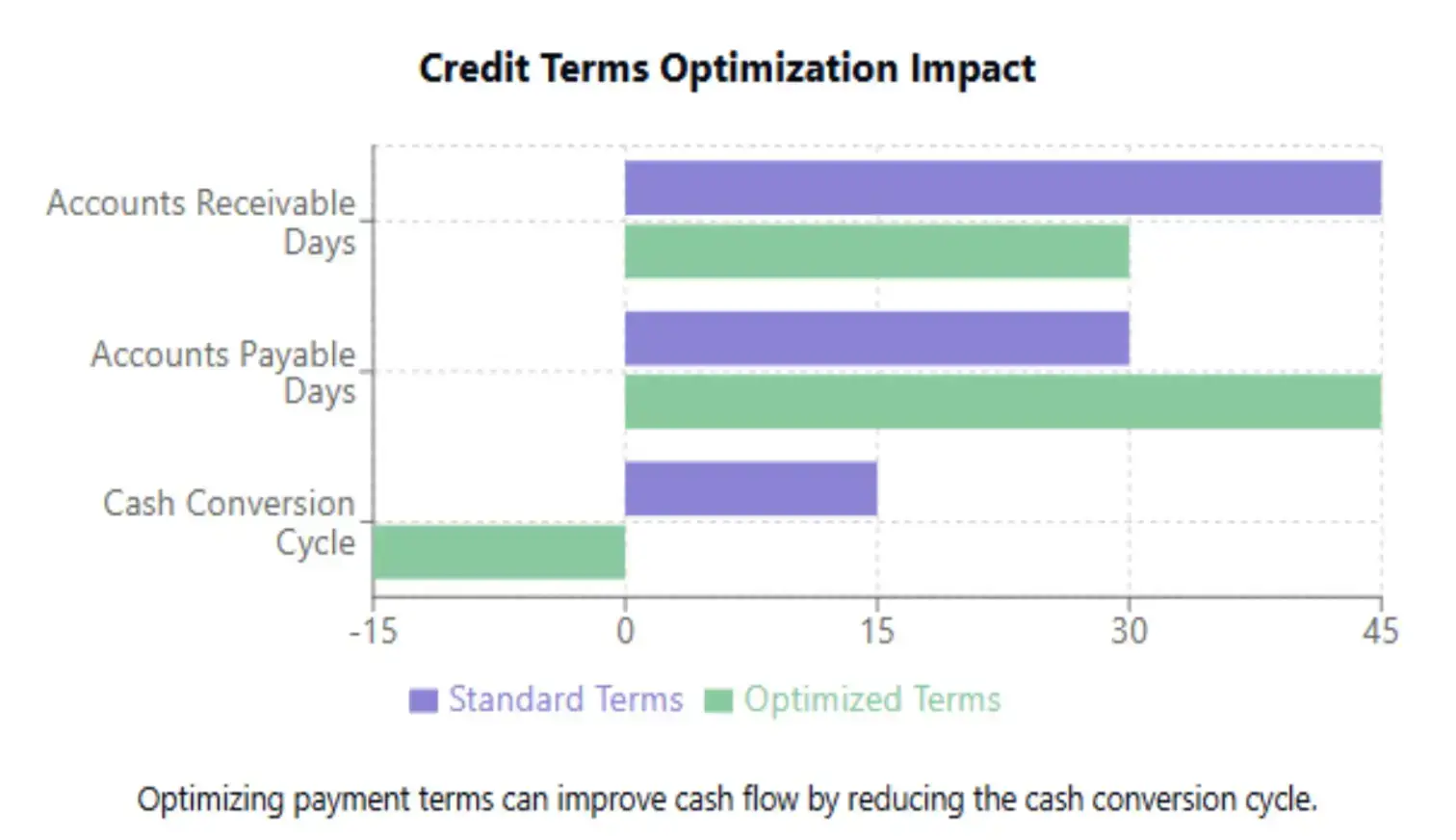

The core of cash flow management is negotiating longer repayment schedules and shortening your cash conversion cycle.

Employee compensation is an effective cash flow management tool because, in a sense, it lengthens the period for repaying employees for their efforts. This principle can also be applied to other areas of the business.

You can start by negotiating longer repayment schedules and periodically reminding your customers of their dues.

However, optimization of credit sales and purchases beyond a certain point requires strategic adjustments to business policies. Specifically, it requires you to change who you choose to do business with.

A supplier with limited market presence and cash reserves may not be able to serve customers who wish for a longer repayment schedule. Hence, you may need to move to other, larger suppliers.

In certain cases, you may have to accept higher costs in exchange for longer repayment schedules.

Similarly, you must utilize insights from your customer relationship management (CRM) platform to identify the profile of customers who are more consistent with their payments.

4. Choose the Right Debt Option for Your Cash Flow Needs

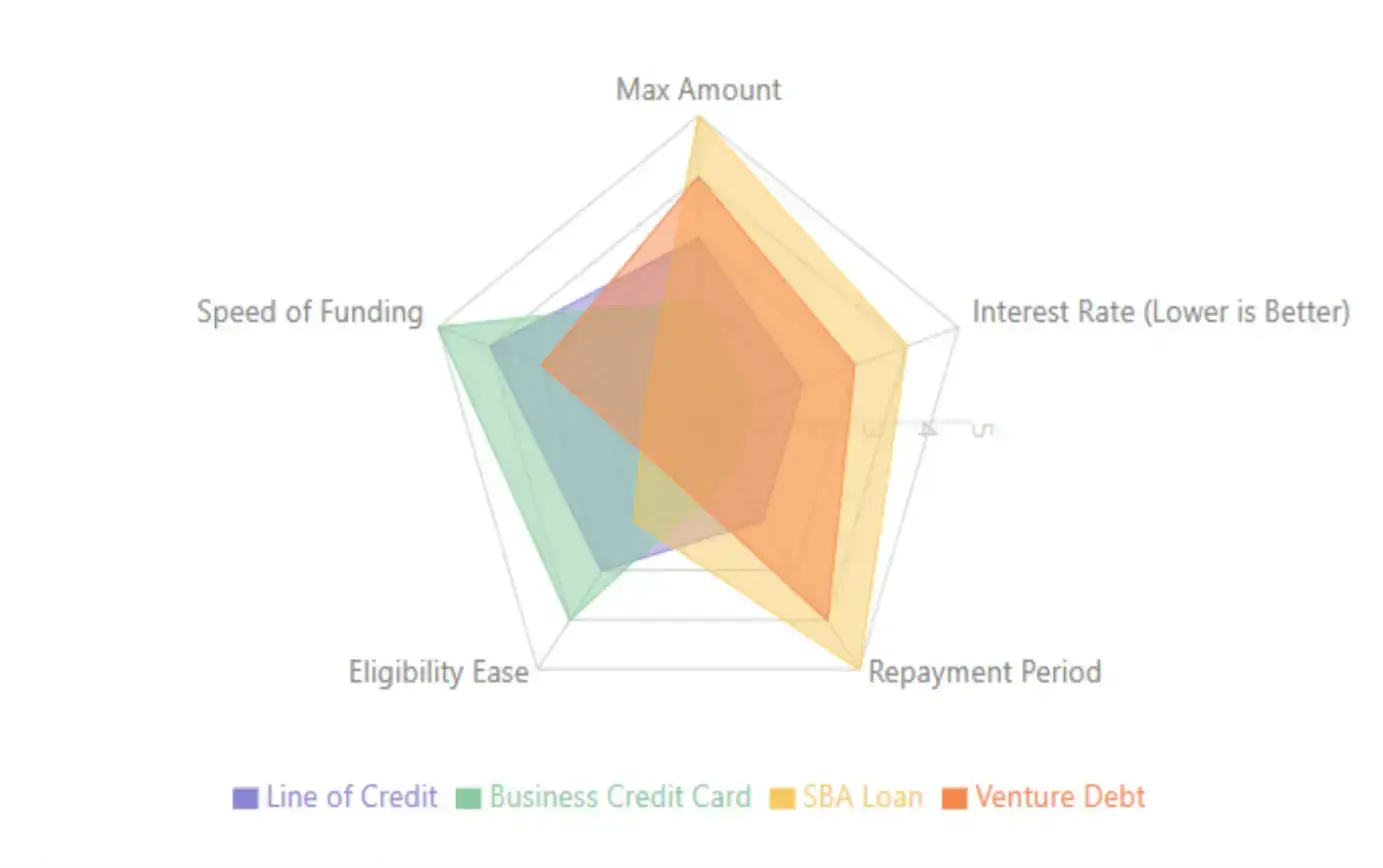

To effectively solve your cash flow issues through debt, you must first identify the type of cash flow issues your startup is facing.

Does your startup experience cash crunches periodically that leave you vulnerable to losing clients? Or is your startup’s burn rate unsustainable given the funding you have raised?

Periodic cash crunches can be tackled using lines of credit, 0% APR business credit cards, business credit cards, and other short-term financing options.

An unsustainable burn rate requires long-term debt. In the US, two promising long-term debt sources would be SBA loans and venture debt.

Such loans are available only to creditworthy businesses that cannot raise debt from non-government sources and meet certain size requirements.

Venture debt, the other promising source of debt, is available to startups that have previously raised funds from venture capital (VC) firms.

Typically, a startup can raise 20% to 40% of their previous funding round through venture debt. Since this is a type of debt that often comes with an interest-free period, it can be extremely helpful for managing cash flows.

5. Use Cash Flow Management Tools for Forecasting and Planning

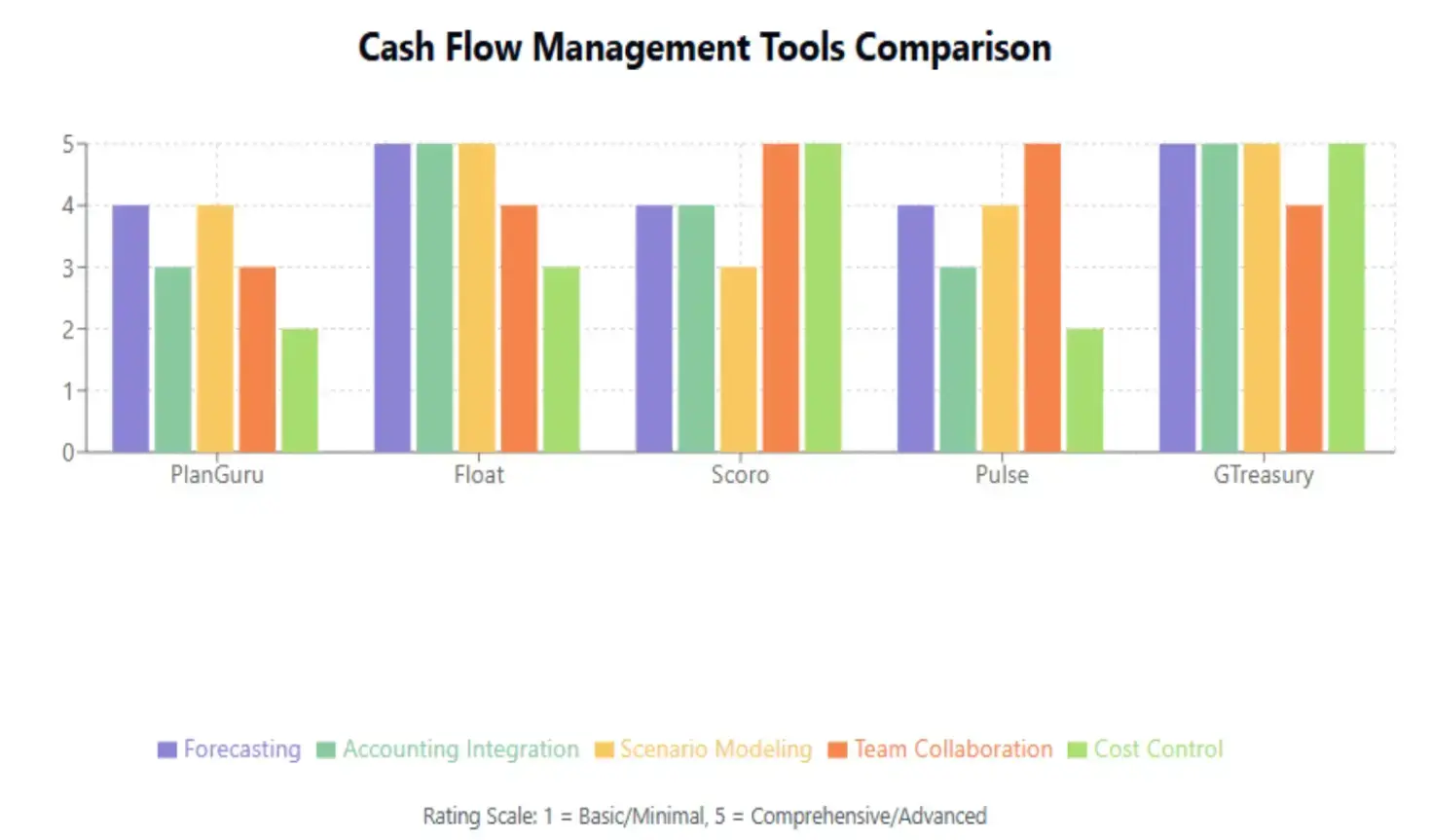

You can use a variety of tools, such as PlanGuru, Float, Scoro, and Pulse to build forecasts and manage cash flow more effectively. Many of these tools integrate seamlessly with popular accounting platforms.

For example, Float offers robust scenario modeling features and connects directly with both QuickBooks and Xero to keep forecasts up to date with real-time financial data.

Cash flow management solutions vary in complexity and scope. Pulse is ideal for straightforward forecasting, scenario visualization, and team collaboration, making it a great choice for early-stage startups.

In contrast, Scoro provides a comprehensive business management platform that goes beyond cash flow. It includes features like cost control, invoice automation, project tracking, performance analytics, and time management tools, making it especially useful for operations managers.

For larger enterprises, advanced tools like GTreasury are better suited.

GTreasury automates cash flow forecasting, manages intercompany transactions, tracks payments, and even supports in-house banking.

FAQs on Startup Cash Flow Management

1. Why is cash flow management critical for startups?

Effective cash flow management ensures that startups can cover operational expenses, survive downturns, and seize growth opportunities without overly relying on debt. It also prevents premature shutdowns due to poor liquidity.

2. How much do employee compensation costs impact a startup’s finances?

Employee compensation can account for 65% to 80% of a startup’s total operating expenses. Managing this expense smartly, such as by offering stock-based compensation is crucial for controlling burn rate and extending the runway.

3. What is stock-based compensation, and how does it help with cash flow?

Stock-based compensation allows startups to defer cash payments by offering equity instead of higher salaries. This ties employee wealth to the company’s success and reduces immediate cash outflows, helping preserve working capital.

4. What are cliff vesting and periodic vesting?

Cliff vesting delays equity vesting until after a set period (e.g., one year), ensuring only long-term employees earn stock. Periodic vesting distributes stock over time (e.g., monthly over four years), spreading the compensation expense and promoting retention.

5. Are there tools or strategies startups can use to better manage cash flow?

Yes. Startups can use forecasting and scenario tools like Pulse, Float, or Scoro to visualize cash trends and plan accordingly. Additionally, negotiating credit terms, budgeting around the next funding milestone, and exploring debt options like SBA loans or venture debt can help.

Key Takeaway: Focus on Employee Compensation First

According to the 80-20 rule, 80% of the outcome is influenced by 20% of the inputs. In case of cash flow management as a startup, the 20% you should focus on is the employee compensation costs.

Such costs can account for about 65% to 80% of your total operating expense and can be optimized through stock-based compensation.

To issue stock-based compensation in a tax-compliant manner, you require a 409A valuation.

Author Bio

Tomas Milar is paving a visionary path in fintech with the goal of creating $1 trillion in assets under administration through Eqvista’s pioneering Real-Time Equity Management™ platform. As the founder of Eqvista, Tomáš has revolutionized the equity management landscape by offering real-time solutions for equity issuance, 409A valuations, company share distribution, and cap table management. He is passionate about helping founders navigate the complexities of equity, valuation, and growth. You can reach out to him directly at tom@eqvista.com.