Keeping the high demand and popularity of online shopping culture in mind, eCommerce portals leave no stone unturned in providing the utmost customer satisfaction.

Using the best email marketing strategies, secure payment gateways, seamless transactions, and convenient doorstep delivery have become the need of the hour.

While shopping online, a customer's most essential concern is making a payment through a secure payment gateway.

For those new to online shopping, a payment gateway is a channel that allows customers to transfer money from their bank account to the retailer after shopping online.

How Payment Gateways Help Your Online Store

Payment gateways support and accept electronic payments and enable the processing of credit and debit cards. Read on to learn the benefits.

- Faster & secure transactions

Payment gateways act as mediators between buyers and sellers. They help manage a customer's confidential information, such as their debit card number, CVV code, expiry date, and more. - Saves time & provides a better user experience

A smooth transaction process eliminates the possibility of cart abandonment and reduces the chances of buyers navigating to a competitor's website. - Payments are accepted worldwide

E-commerce store owners can expand their business globally by setting up a secure payment gateway. - Almost no declined transactions & automated payments

Less human intervention is something every eCommerce shop owner wants. - Fraud detection tools

A payment gateway eliminates delayed payments, poor processing, and late deliveries.

What’s the Big Deal About Payment Gateway Security?

From a buyer’s perspective, a secure payment gateway is essential for the ideal flow of online payments.

From a merchant’s perspective, a secure payment gateway can protect them from expired cards, insufficient funds, and exceeding card limits.

From a restaurant owner’s perspective, a secure payment gateway for restaurant payroll software can protect employee financial information and ensure accurate, secure salary payments.

The service provider encrypts all data during the entire payment gateway process, so both buyers and merchants can rest assured.

E-commerce merchants must also maintain payments compliance with industry standards like PCI DSS to meet regulatory requirements and protect against costly penalties or data breach liabilities.

Implementing and Using a Secure Payment Gateway

Now that you know the importance of a secure payment process, it’s time to dive deeper.

1. Check with your web host first

Your web host or software provider will assist you in implementing the payment gateway services quickly on your portal.

2. Research payment gateway options and providers

You can find multiple options online. The most important thing is to find gateways supported by your shopping platform’s software.

One of the best ways to reduce cart abandonment is to provide multiple payment options. Choose gateways that are globally accepted for uninterrupted services.

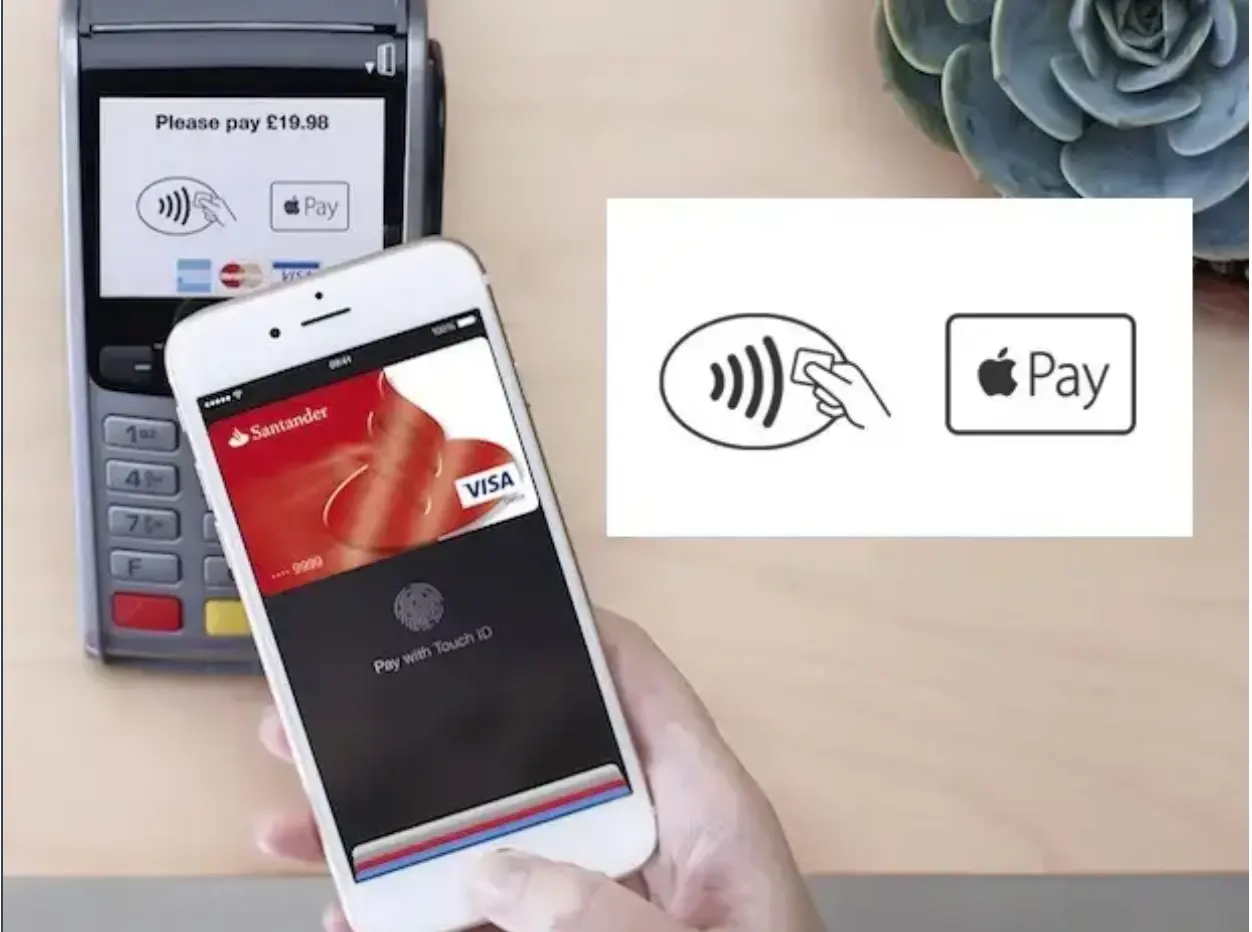

Apple Pay

It is one of the most renowned payment gateways with a robust anti-fraud team. 65% of all US retail locations now accept it as a payment method.

Stripe

Stripe is known for easy setup and customized solutions. It also offers simplified checkout processes like one-click checkout.

If you run a subscription business, you might consider a Stripe Billing alternative like Chargebee, which manages secure payments and custom subscriptions.

Reducing friction at checkout is vital for improving sales.

3. Payment gateways charge a one-time setup fee

Payment gateways typically charge setup, monthly, and transaction fees. Compare rates and find a service that best meets your needs.

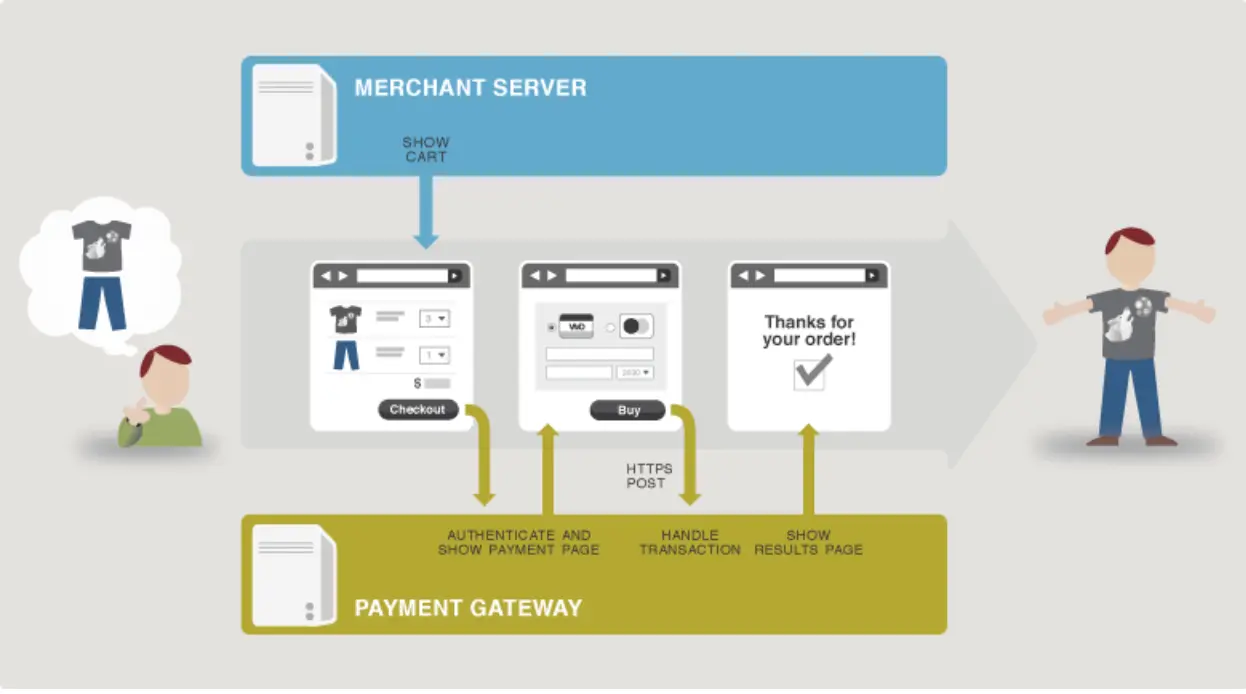

4. Choose between the direct and external gateway

External gateways redirect users to another site to process payment, while direct gateways process everything within your portal and keep customers on-site.

If possible, use a direct gateway for a professional and seamless user experience.

5. Easy integration of payment gateways

- Most retailers use third-party software that handles order pages and transfers payment info to the gateway.

- Enter gateway info for every payment method (Visa, Mastercard, etc.).

- Test everything before going live to ensure accuracy and security.

- If you have physical stores, integrate your gateway with your POS software for a seamless experience.

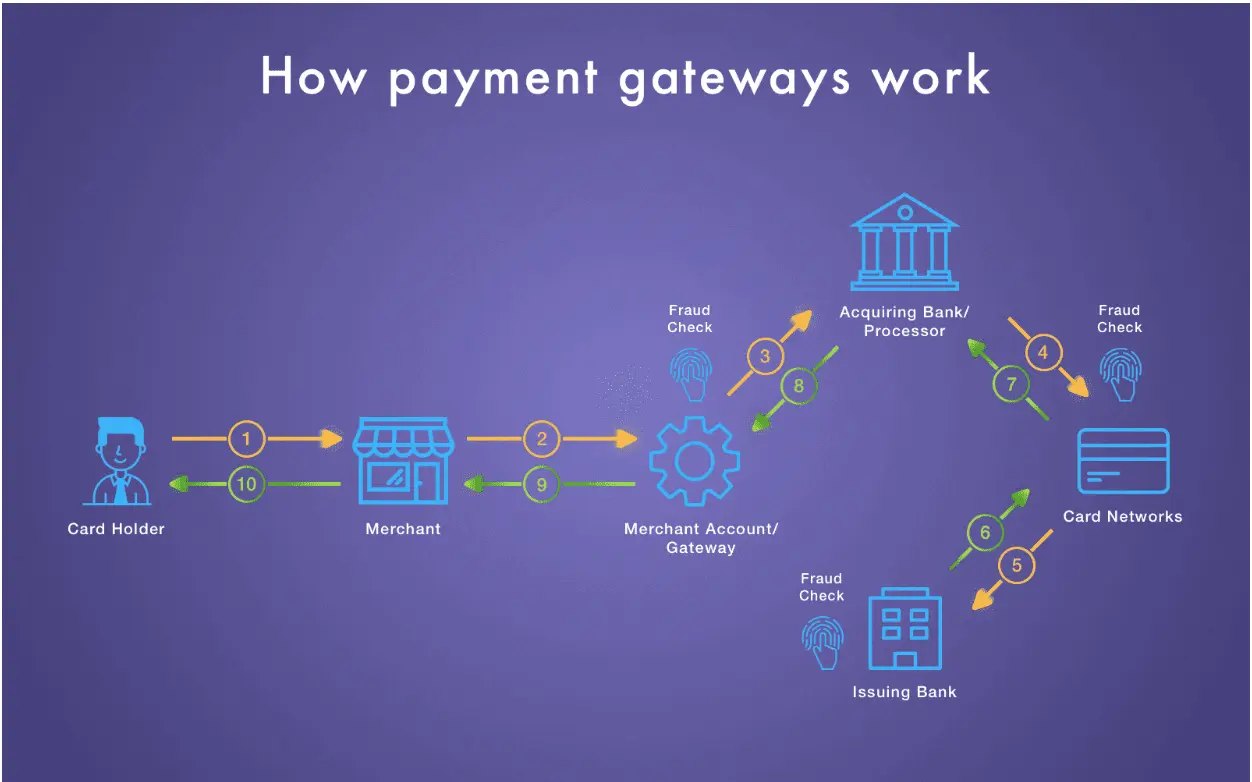

How Online Payments Work

- The buyer selects a product and proceeds to checkout.

- The user fills in payment details.

- They confirm all details are accurate.

- The customer’s bank sends an approval message.

- The merchant receives approval and ships the order.

- The bank settles the payment.

- The process completes when the merchant receives full payment.

Payment Gateways Make Shopping Easy

Be it any online business, carrying out secure transactions is the first and foremost responsibility of an e-commerce store owner.

To ensure maximum conversion of your prospects, provide multiple online payment modes.

If you want to integrate a secure payment gateway, find a reliable, experienced software vendor. Once setup is complete, you can make shopping delightful for your customers—ensuring better sales and profit for your eCommerce store!

Ecommerce helpdesk software can also help you resolve customer issues quickly.

Author Bio

Shweta is a growth marketing specialist working with 2xSaS. She creates content that converts website visitors into paying customers for SaaS companies.

In her free time, she likes driving around the city & hanging out with her friends. You can email Shweta at Shweta@2xsas.com.