The retail commerce landscape is evolving rapidly. And one of the biggest drivers is technology innovations and changing consumer preferences. One such technology is the implementation of QR codes in checkout.QR code checkout allows customers to skip long lines and pay instantly by scanning a code on their smartphone. This technology has the potential to completely reshape the in-store shopping experience and define the future of retail transactions.

And not just for brick-and-mortar stores, it also makes the checkout process hassle-free for eCommerce customers. They don’t have to keep their card details with them all the time — just scan the code and pay online.

Though QR codes have been around for a while, their use at the point of sale for contactless payments has skyrocketed in recent years.

In this blog post, we explore the benefits of QR code checkout, current use cases, and how this technology will reshape retail and eCommerce going forward. Let’s dive right in!

What is QR Code Checkout?

QR code checkout is a contactless payment method that allows customers to complete purchases by scanning quick response (QR) codes using a smartphone.

It is an alternative to traditional checkout involving physical cards, cash, and payment terminals. The retail sector has recently adopted QR codes to facilitate digital payments and checkout.

How Does a QR Code Checkout Work?

The entire process of QR code checkout relies on connecting three key elements: the customer’s smartphone, a unique QR code, and a digital payment system.

Here is a step-by-step overview of how QR code payments work:

- Retailer integrates a QR payment system into their checkout operations, either custom-built or leveraging a QR code provider.

- At the checkout location, the QR payment system generates a unique QR code tied explicitly to that transaction.

- The retailer or eCommerce store displays the transaction's QR code on a screen, sign, receipt, or other surface for the customer to scan.

- Customer opens their chosen payment app on their smartphone and scans the QR code using the phone's camera.

- The payment app decrypts the QR code to extract the payment request details.

- The customer authenticates via fingerprint or facial recognition to authorize payment.

- The payment app then communicates with the retailer's QR payment system to process the transaction securely using the customer's stored payment method.

- The retailer's payment system confirms the transaction is completed, updating the checkout PoS system.

- The customer receives notifications of successful payments and digital receipts on their payment app and in email.

- Retailer gains access to transaction data for accounting, customer analytics, and marketing purposes.

The entire checkout process takes seconds without customers needing to swipe cards, cash handling, or playing with payment terminals. Customers simply scan, authenticate, and go on their way.

Benefits of QR Code Checkout for Customers and Business Owners

QR code checkout offers great benefits for both consumers and retailers:

1. Speed and convenience

One of the biggest benefits of QR code payment is the increased speed and convenience compared to traditional checkout and payment methods.

Shoppers at offline stores can finish transactions in seconds without the hassle of digging out cash or cards. This way, even retailers are able to serve customers faster, reducing long wait times.

And for eCommerce, only 8% of customers think that it’s safe to store their card information online. So, with QR code checkout, not only does the payment process become convenient, but it’s also safer.

2. Enhanced security

Talking about safety, it’s a major concern for both retailers and shoppers when it comes to payment transactions.

Credit card fraud from compromised card data is a massive issue, with nearly 40 billion in losses annually. And 92% of these frauds involved a credit card.

QR code payments, however, are virtually impenetrable to these common security threats.

With QR code payments, the credit card number is never exposed or transmitted. The QR code itself simply activates the payment from the connected digital wallet when scanned.

The cryptographically encrypted QR codes cannot be replicated or decoded to expose sensitive information. Even in the backend systems, QR tokenization means credit data remains isolated from retailers' systems.

This protects retailers from suffering damaging breaches. Apple Pay, Google Pay, and other QR payment apps keep user data secure via blockchain encryption technology and biometric authentication like fingerprint or face scanning.

3. Integration with offers and loyalty programs

Another major benefit of QR code checkout is the ability to integrate rewards programs, discounts, coupons, and other promotional offers into the payment process.

Traditionally, applying coupons or loyalty program discounts during checkout requires multiple separate steps that slow down the process.

The customer informs the cashier they have a coupon, the cashier then has to enter codes manually, and then discounts have to be separately calculated and applied to the transaction.

With QR code payments, this entire process is streamlined into one simple scan.

The customer's loyalty account information and any eligible coupons or offers can be automatically linked to the unique QR code tied to the customer’s mobile payment app.

And when the customer scans the QR code at checkout, the discounts and rewards are instantly calculated and applied behind the scenes.

Read more about customer loyalty.

4. Better customer data and insights

The data collected from QR Code payments and digital receipts provides retailers with valuable customer insights. You get visibility into purchasing habits, consumer behavior, preferences, and demographics to better target marketing efforts.

Moreover, QR Code checkout also allows you to experiment and test different offers, features, or prices to optimize the checkout process for the best outcomes.

To accommodate modern consumers, integrating custom dynamic QR codes into your retail or eCommerce business offers not just enhanced security but flexibility with promotions and analytics.

Employing a platform where you can customize and track these codes contributes significantly to optimizing the checkout process.

How to Create a QR Codes Checkout Journey for Your Business?

If you’re a business owner and think creating and implementing a QR code checkout journey is difficult — you’re probably wrong. It takes some work and effort but is not difficult at all.

Implementing QR code checkout requires creating customized QR codes that integrate seamlessly with your payment systems. Here are some tips to generate the right QR codes for accepting mobile payments:

1. Select a reliable QR code generator

Don’t rely on free online generators for transactions. Invest in a paid, specialized QR code generator like Uniqode or QR Tiger's QR code generator for secure checkout codes.

Paid QR code generators offer dynamic encryption, design templates, analytics integrations, and ongoing tech support suitable for payments. They also provide secure hosting to protect payment data.

2. Choose appropriate code type

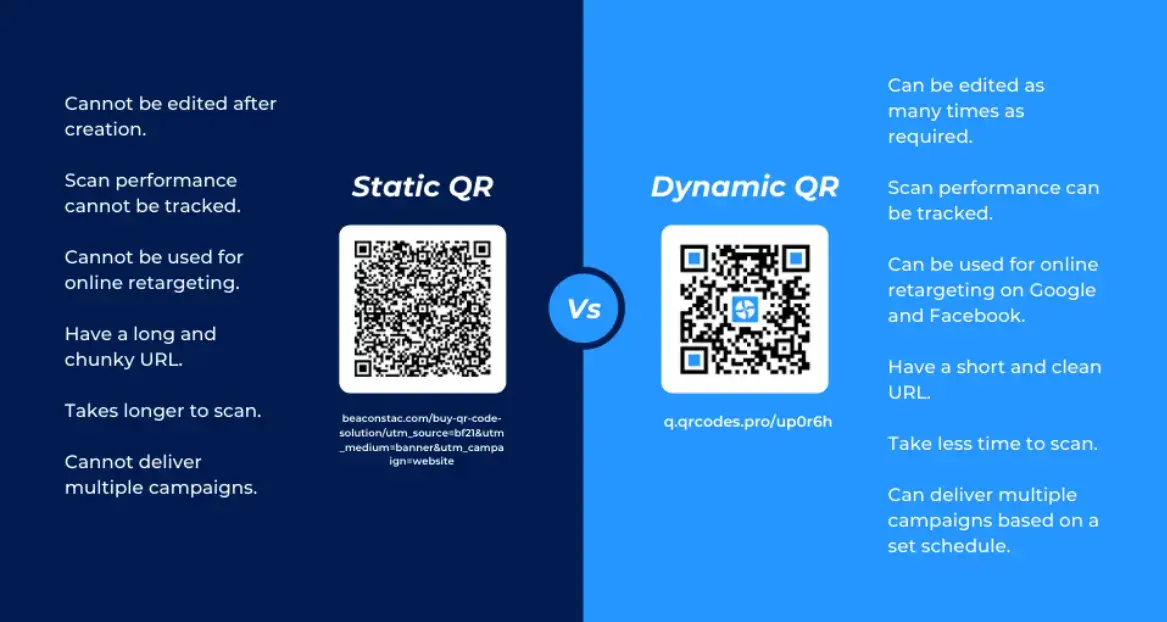

Opt for dynamic crypto QR codes with back-end database connectivity for checkout codes. These change with each transaction and sync with your payment processors in real-time.

Dynamic crypto codes are essential for security, flexibility, and actionable analytics relative to static QR codes.

3. Customize design thoughtfully

Make sure your checkout QR codes reflect your brand. Most paid generators give you full customization of colors, logos, eyes, rounded or square edges, and other stylistic elements.

Keep in mind checkout codes must be clearly visible and scannable. Avoid intricate details that could interfere with reads.

4. Add special features

Consider useful extras like applying scan limits to codes, location controls, and detailed analytics tracking. Scan limits prevent fraudulent mass scans.

Location controls allow you to target codes in specific stores. With robust analytics, you have visibility into code performance and customer behavior.

5. Rigorously test before launch

Thoroughly test your checkout QR codes across different devices, operating systems, and payment apps.

Verify quick response times and completely seamless payments before rolling out. Work out any bugs beforehand to avoid frustrating users once launched.

6. Monitor performance post-launch

Keep monitoring code analytics after launch to spot issues and identify improvements. Look at scans, payment failures, lag times, and customer behavior flows.

Adjust code placement, features, or design elements to optimize ongoing performance.

7. Promote usage

Don’t just display your QR codes and expect customers to use them. Educate shoppers on QR payment through signage, social posts, staff assistance, and offering incentives.

Promote the benefits of faster checkout to drive adoption. Usage promotion is critical for transitioning customers to QR payments.

Conclusion: Transform the Checkout Experience with QR Codes

QR code checkout is a major evolution in retail payments and commerce. Retailers who quickly embrace this technology can gain real advantages over their competitors.

Consumers are ready and eager to use QR codes to improve their shopping experiences.

Though mainstream adoption is still in the early phases, all signs point toward QR payments becoming integral and transformative across retail channels in the near future.

The disruptive impact of QR codes will fundamentally reshape the checkout experience retail and eCommerce landscape as consumers know it.