There are many pieces to the e-commerce business puzzle, but none is more important than processing payments.

All the money, time, and effort you put into starting and running your business is lost if you don’t have an optimal payment process.

Take five or six minutes and read about what online payments are, how to accept payments online, and ways to improve your ecommerce payment processing.

Article Shortcuts:

- What Are Online Payments?

- How Can I Accept Online Payments?

- Top 3 Types of Online Payments

- How To Improve Your eCommerce Payment Processing

Custom image created in Canva

What Are Online Payments?

Online payments are electronic payments that are made over the internet. They are a convenient and secure way to pay for goods and services online.

Online payments are a convenient way to pay for goods and services anywhere, anytime. Orders are processed quickly, efficiently, and securely.

Payment processors use multiple levels of encryption to protect the customer’s sensitive payment information.

How Can I Accept Online Payments?

The best way to accept online payments for your business will depend on your specific needs and requirements.

Custom image created in Canva

Here are some factors to consider when choosing a payment method:

- Types of payments you plan to accept: Some payment methods, such as credit cards, are more widely accepted than others.

- Fees charged by the payment processor: Different payment processors charge different fees. Compare different processors' fees to find the best fit.

- Security features you need: Ensure that the payment processor you choose offers strong security features to protect your customers' data.

- Integration with your website: The payment processor must integrate with your website host.

Once you have chosen a payment method, you will have to set up an account with the provider. The exact process will vary depending on the payment processor.

Then, you must create a payment button to add to your website. Customers who click the button will be taken to the payment processor's website to complete the transaction.

Top 3 Types of Online Payments

- Credit card payments

- Digital wallets

- Direct ACH

The growth of e-commerce has led to a surge in online payments. People are more comfortable buying goods and services online and are more likely to pay for them using electronic methods.

For instance, in 2021, statistics showed that two-thirds of adults made or received a digital payment.

Here are some of the three most popular types of online payments:

-

Credit card payments

Credit card payments are the most common type of online payment. They are processed through a payment gateway, which is a secure server that encrypts the customer's credit card information.

Similarly, debit cards come in at #2 and are processed like credit cards, except the funds come directly from your bank account instead.

-

Digital wallets

A digital or mobile wallet is a software-based payment system that allows you to make payments online or in-store using your mobile device.

Digital wallets store your credit card, debit card, or bank account information so that you can make payments without entering your details each time.

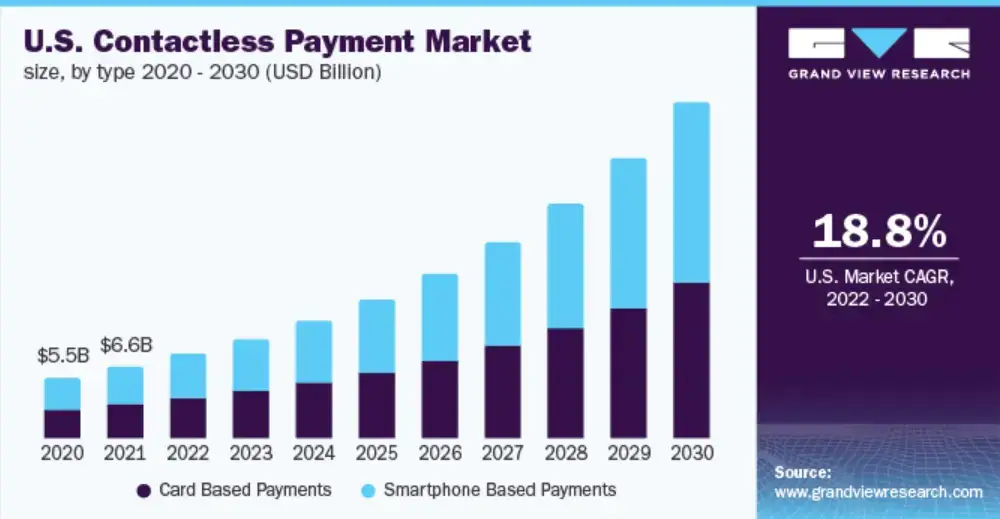

Ever heard of Apple Pay? Google Pay? CashApp? They are all digital wallets; statistics show they will grow exponentially in the coming years.

-

Direct ACH

Direct ACH (Automated Clearing House) is a way to accept payments directly from a customer's bank account. This method is often used for recurring payments, such as subscription-based billing. Suffice it to say that offering multiple ways to pay on your ecommerce website is the only way to see future growth.

How To Improve Your eCommerce Payment Processing

You can create a positive and memorable payment processing experience for your customers that will help improve your ecommerce conversion rate and boost your sales.

Custom image created in Canva

A common mistake is simply following your chosen platform's onboarding process and thinking that will suffice. There is more to it than that.

-

Offer multiple payment options

As previously mentioned, you want to offer multiple payment options. First, you must consider your geographic target market and ensure that your payment options are accepted in that country or region.

This will make it more convenient for customers to pay and can also help to reduce cart abandonment.

-

Simplify and secure your checkout process

There is no simpler or more secure process than the one-click checkout offered by Link.

Should you choose not to offer it, ensure that your process is easy to follow and will make the customer feel that their personal and financial information will be kept private. Using a secure payment gateway is the best way to go.

-

Use fraud detection tools

Find a highly recommended fraud detection tool to help prevent fraudulent transactions. These tools typically use a combination of factors to assess the risk of a transaction, such as the customer's IP address, billing information, and purchase history.

-

Optimize checkout for mobile devices

It's important to ensure that your checkout page is optimized for mobile devices so customers can easily complete their purchases. The primary reason for abandoned carts in ecommerce is friction at the point of checkout, and as mobile users continue to climb, optimizing for mobile checkout cannot be overlooked.

-

Offer live chat support

If customers have any questions or problems during the checkout process, they should be able to get help quickly and easily. Live chat support is a great way to provide this assistance and can be added with a simple chat plugin.

-

Get customer feedback

Ask your customers for feedback on their payment experience. This will help you to identify areas where you can improve.

Customer will gladly let you know what you got right or wrong. Use it as an opportunity to connect directly with your customer base.

Going the extra mile to ensure a positive customer experience can be the difference in hitting and missing your revenue targets.

In Closing

I hope you’ve learned enough about e-commerce payment processing in this article to improve your ecommerce store.

A quick review – improve your online payment collection experience by offering multiple payment options, making the checkout process simple and secure, using a reliable payment processor, keeping your payment information up to date, and talking to your customers.

Following these tips can create a positive and memorable payment processing experience for your customers for many years.

Author Bio:

Mick Essex is the Growth Marketing Manager at POWR. His career spans two decades, primarily in the healthcare industry, with stints in broadcast television advertising and copy editing.

Mick attended the College of Journalism at the University of Louisiana - Monroe. He and his family currently call Lafayette, Louisiana home. Follow him on LinkedIn.