Nearly everyone has a PayPal account. Many e-commerce shops use PayPal for a seamless checkout experience. Integrating it into your website makes it easier and safer for customers to complete transactions.

Adding a PayPal payment button is easy enough. You can easily do it from scratch using your code or an external plug-in like our POWR PayPal button.

Most site builders allow you to add it from their console. If you're familiar with coding, you can add PayPal to your website in HTML.

But before accepting payments through the platform, you must set up a PayPal Business account. It’s free to do so, but using the service incurs fees per transaction.

And if you want to enjoy the rich suite of finance management and marketing features, then you’ll have to get a paid plan which, considering all that you get, is worth the upgrade.

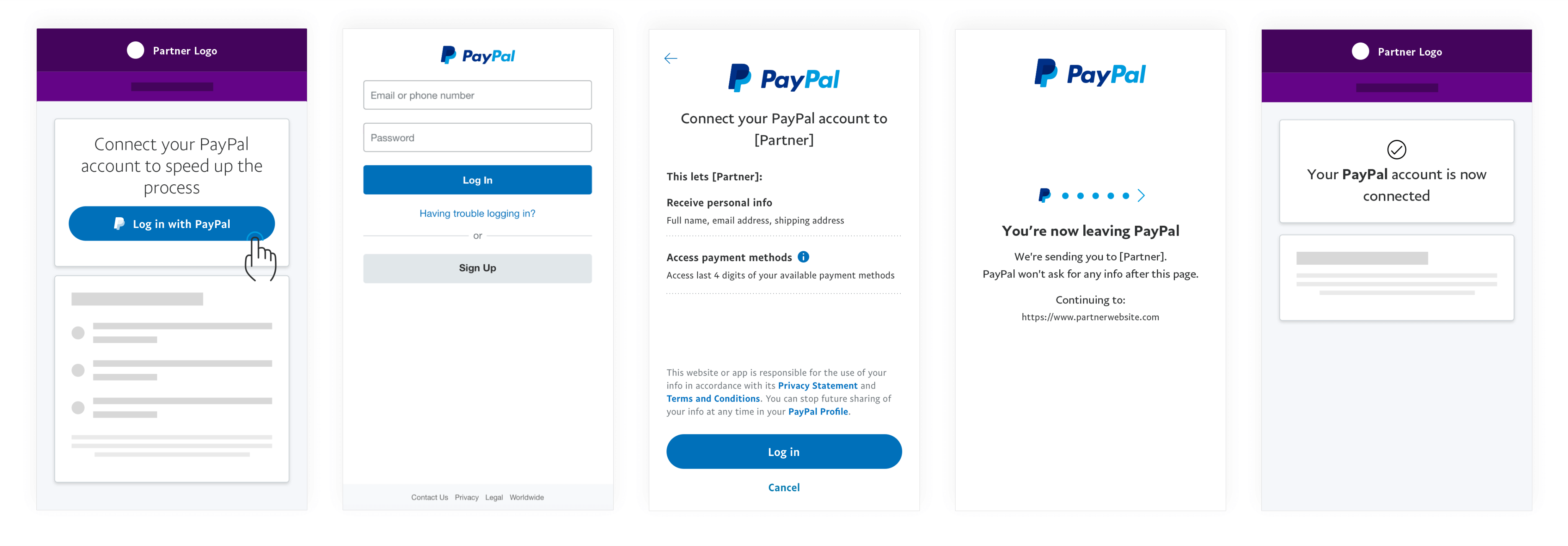

Image Source: Paypal

PayPal Personal Vs. PayPal Business

Everyone starts with a PayPal Personal account. Individuals use it to send and receive payments from family and friends through the platform and pay for goods and services online.

You can link your bank account, debit cards, and credit cards for easy transactions—no more needing to fill out your payment details each time!

There are plenty of differences between Paypal Personal vs Business. The latter is everything of the former, plus more.

PayPal Business has payment integration, supports flexible payment options (in many currencies), includes financial management and marketing tools, and is scalable for large businesses.

It addresses the needs of shops that deal with numerous online or offline transactions.

Can I Use PayPal Personal For Business?

Some entrepreneurs, such as small business owners, freelancers, and casual sellers, use PayPal Personal for selling e-commerce products while others leverage The Venmo app for peer-to-peer transactions.

It’s possible and even ideal if you only occasionally receive payments, although you still have to pay transaction fees when getting paid by clients.

That said, if you’re a large business with a range of products selling to a broad customer base, upgrading to PayPal Business is a smart choice since it can handle the mass of transactions.

Image Source: Paypal

How Much Does It Cost To Use PayPal Business?

Creating and using a PayPal business account is generally free. However, the platform charges certain fees per transaction:

- Invoicing: 3.49% plus a fixed fee

- PayPal Checkout: 3.49% plus a fixed fee

- PayPal Guest Checkout: 3.49% plus a fixed fee

- PayPal Guest Checkout – American Express Payments: 3.50%

- Quick Response (QR) code Transactions – $10.01 and above: 1.90% plus a fixed fee

- QR code Transactions – $10.00 and below: 2.40% + fixed fee

- QR code Transactions through third-party integrator: 2.29% + $0.09

- Pay with Venmo: 3.49% plus a fixed fee

- Send/Receive Money for Goods and Services: 2.89% plus a fixed fee

- Standard Credit and Debit Card Payments: 2.99% plus a fixed fee

- All Other Commercial Transactions: 3.49% plus a fixed fee

The fixed fee depends on the currency used to pay and the payment method used.

How To Lower PayPal Business Fees

The number of PayPal fees can add up, eating away a large chunk of your profit. However, there are ways to avoid paying these hefty charges.

Factor in PayPal Transaction Fees

When crunching the numbers, consider the deductions from PayPal transaction fees and factor them into your pricing. That way, you reduce the amount you have to pay from your profit.

Encourage Other Payment Options

PayPal allows multiple payment options—some with cheaper transaction fees than the rest. Encourage your customers to use these alternative payment options so that both you and the buyer can save some cash.

Consider Alternative Payment Processors

If PayPal is taking too much of your revenue, you may start to consider alternative payment processors. Some charge fewer transaction fees, which can save you a ton.

However, PayPal’s trusted network and tried-and-tested functionality are unmatched and might be the preferred payment method that will lead your customers to check out more confidently.

How To Set Up A PayPal Business Account

You can set up a PayPal Business account in less than twenty minutes. Make sure you have ready your business name and address, Employee Identification Number (or Social Security Number, if you’re a sole proprietor), date of birth, and the last four digits of your Social Security Number.

To set it up, go to PayPal.com and create a Business account. Fill in your login details and enter your business and personal information to verify yourself.

Once your account is verified, you can link a bank account to transfer payments, and you’re ready to accept payments from customers!

Conclusion

Setting up a PayPal Business account is free. However, each transaction made through the platform is subject to fees that can add up.

Some ways to lessen these include switching to a cheaper payment processor. But PayPal’s expansive network, built-in trust, and tested security are unmatched, making upgrading a PayPal Business account a wise choice for any ecommerce business.