Tax season can be challenging for small businesses, but it can also be a period of opportunity and growth with the right tools and strategies.

QuickBooks offers features to streamline tax preparation, ensuring compliance and maximizing deductions.

Here's an overview of the top three QuickBooks tools to help small businesses thrive during tax season.

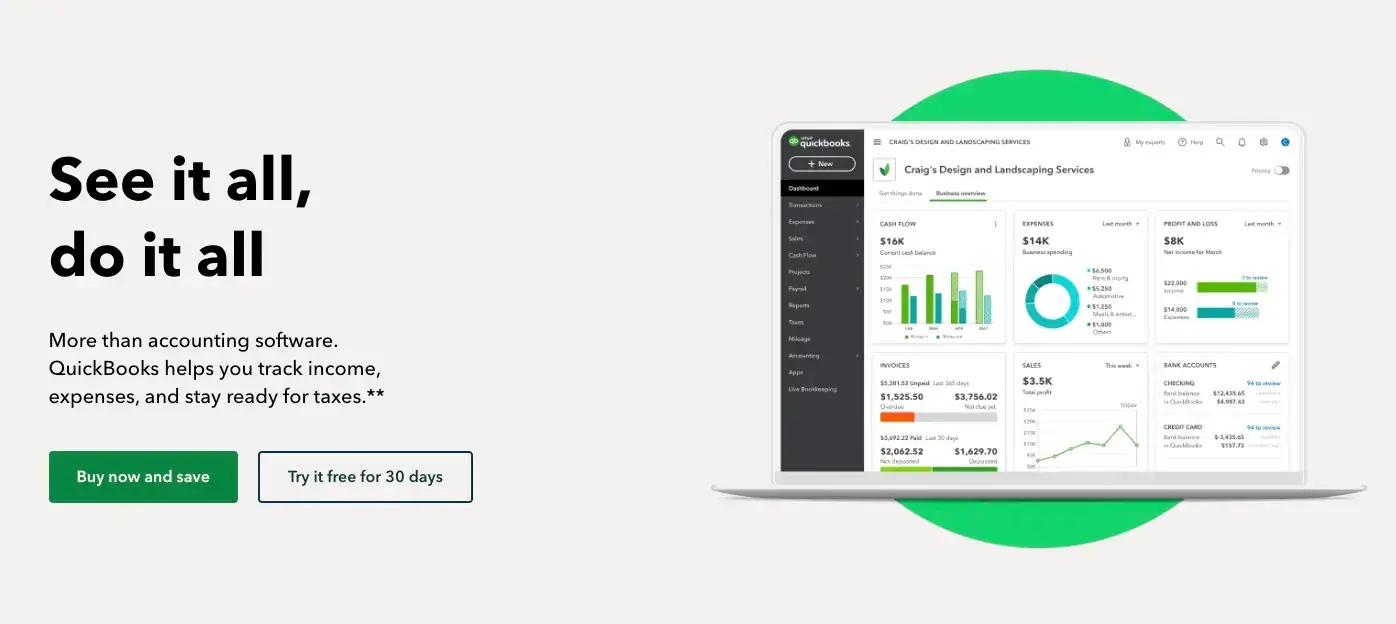

1. QuickBooks Online: Your All-in-One Financial Management Solution

QuickBooks Online is the core of financial management for many small businesses. It provides an all-encompassing real-time platform for tracking income, expenses, and tax deductions.

Its intuitive dashboard offers a comprehensive view of your business's financial health, which is essential for making informed decisions during tax season.

-

Easy integration

Automatically import and categorize bank transactions, simplifying the reconciliation process and ensuring accuracy in your financial reports.

-

Deduction tracking

Track potential tax deductions throughout the year, such as business expenses, home office deductions, and vehicle mileage, to ensure you don't miss out on valuable savings.

-

Tax reports and compliance

Generate detailed tax reports summarizing your taxable income, expenses, and more, making it easier to file accurate returns or share necessary information with your tax preparer.

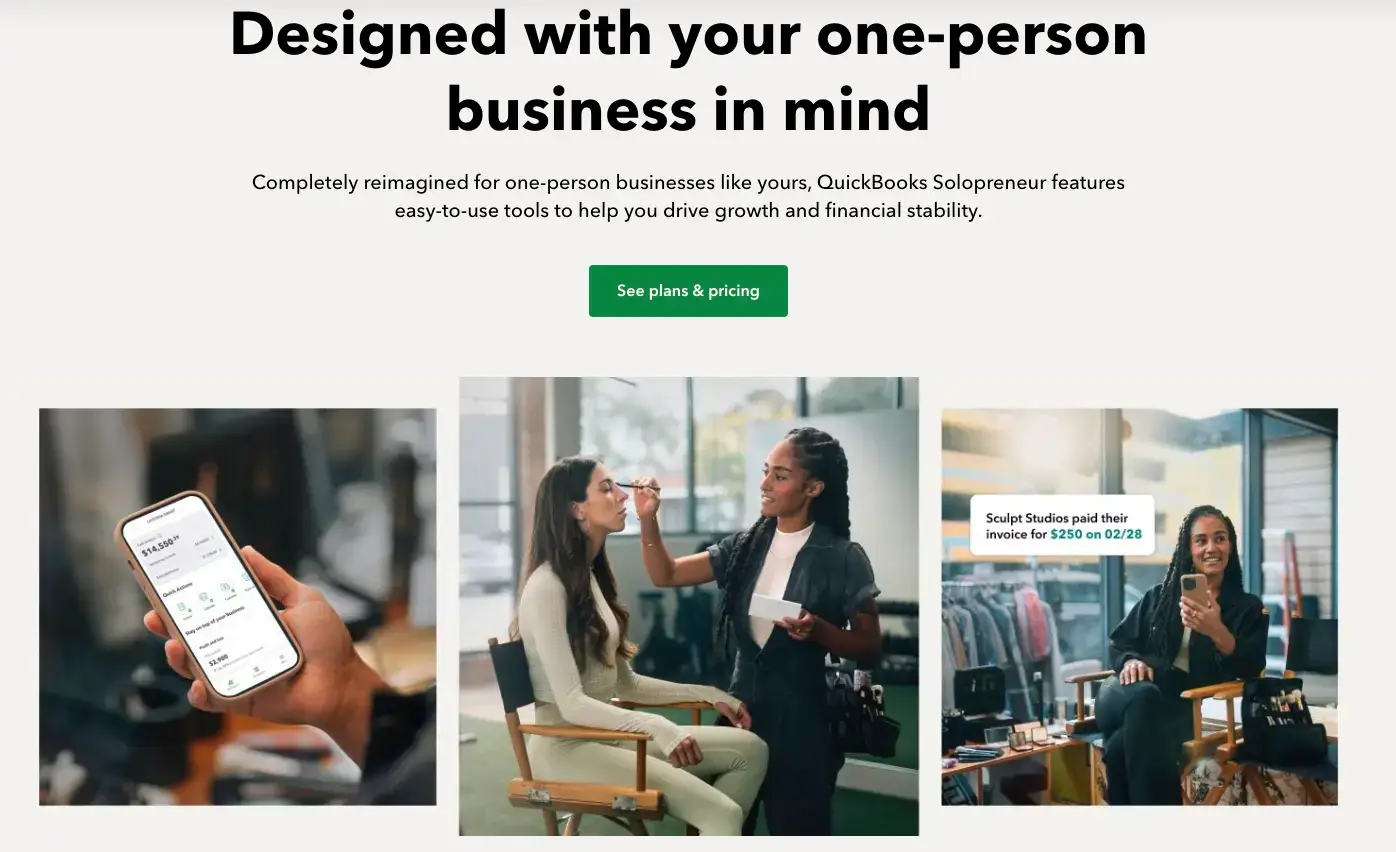

2. QuickBooks Self-Employed: Tailored for Freelancers and Solopreneurs

QuickBooks Self-Employed is specifically designed for freelancers, independent contractors, and solopreneurs, offering features tailored to the unique challenges of managing personal and business finances side by side.

-

Mileage tracking

To maximize deductions, utilize the mobile app to track mileage, automatically distinguishing between personal and business trips.

-

Quarterly tax estimates

Calculate and remind you of quarterly tax estimates, ensuring you stay on top of payments and avoid penalties.

-

Expense separation

Easily separate personal and business expenses, streamlining tax preparation and maximizing deductible business expenses.

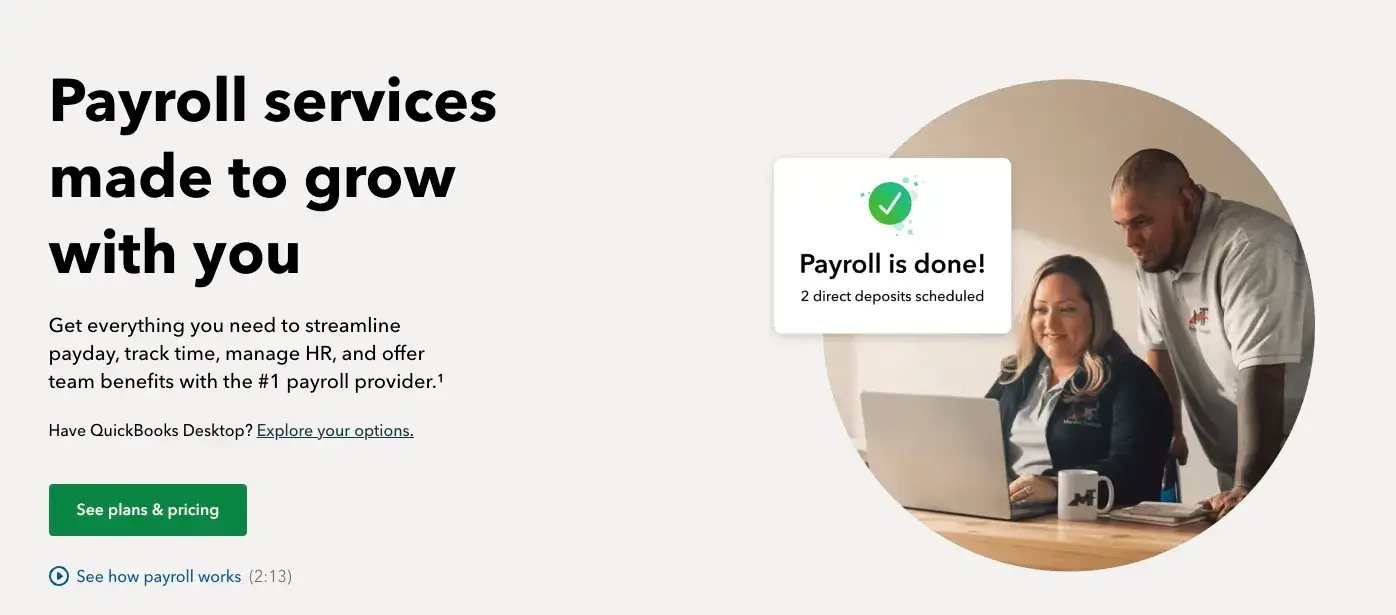

3. QuickBooks Payroll: Simplify Employee and Contractor Payments

Managing payroll can be one of the more complex aspects of running a small business, especially during tax season.

QuickBooks Payroll offers a solution simplifies paying employees and contractors, ensuring tax compliance and accuracy.

-

Automated tax calculations

Automatically calculate and file state and federal payroll taxes, reducing the risk of errors and penalties.

-

W-2 and 1099 processing

Easily prepare and file W-2s for employees and 1099s for contractors directly within the platform.

-

Direct deposit

Offer employees and contractors the convenience of direct deposit, streamlining the payment process and ensuring timely compensation.

Conclusion

Tax season doesn't have to be a source of stress. With QuickBooks' comprehensive suite of tools, small businesses can confidently navigate this critical period.

By leveraging QuickBooks Online, Self-Employed, or Payroll, businesses can ensure accuracy in their financial management, comply with tax regulations, and even uncover potential savings.

Start preparing early, stay organized, and make the most of these tools to set your small business up for success during tax season and beyond.

Don't wait! Take control of your finances and conquer tax season with this special offer from POWR. Save 30% on Quickbooks for 6 months!