Every business has to keep track of metrics to measure success and ensure growth. In other words, metrics serve as measurements for the health of a business.They also serve as a way for the owners and managers of eCommerce marketplaces to realize which benchmarks they’ve met and to set new ones.

In this article, we’ll dive into the many KPIs that are needed to evaluate business development and success in eCommerce.

6 E-Commerce Metrics You Have to Track

- AOV (Average Order Value)

- CAC (Customer Acquisition Cost)

- Order Fulfillment Rate

- GMV (Gross Merchandise Volume)

- ROI (Return on Investment)

- SPAM (Sales Price Above Minimum)

We’ll also cover how eCommerce sellers can set their own KPIs depending on their business goals and concepts. Using these metrics, you can analyze your business’s current performance and future goals.

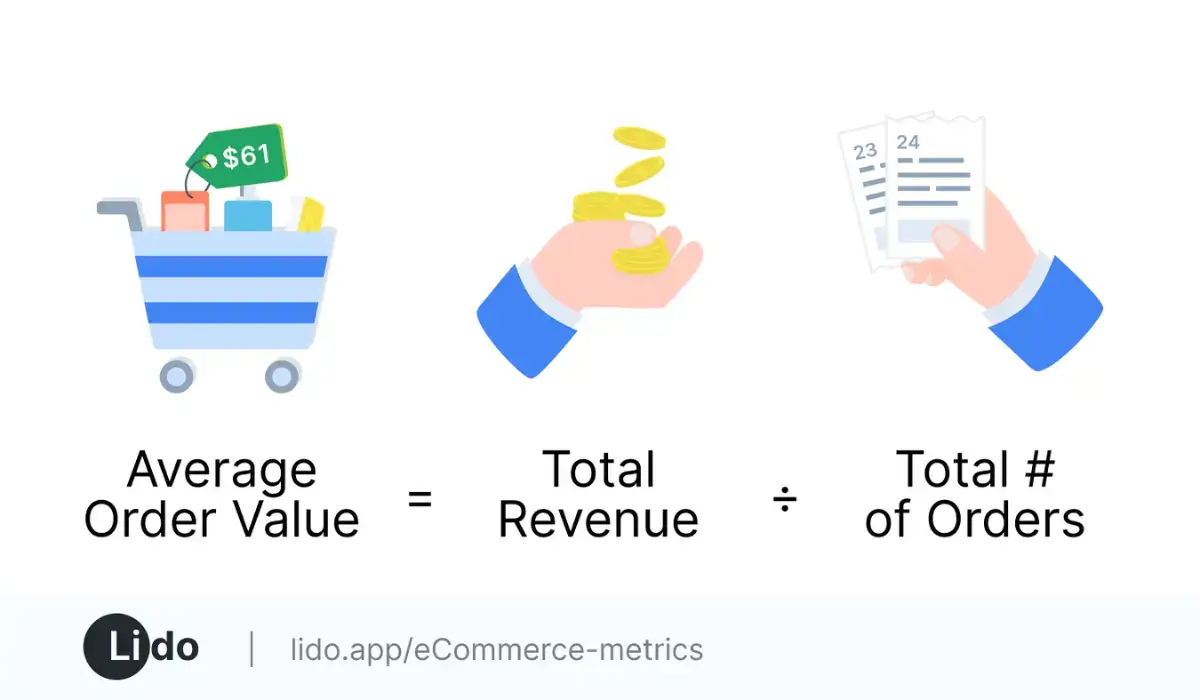

1. AOV (Average Order Value)

Source: Lido

Your AOV (Average Order Value) is a reflection of how much your customers are spending for each new order they make and the number of sales per order as opposed to per customer.

To calculate AOV, take your total revenue over a specified period (annual, monthly, weekly, or daily), and then divide it by the total number of transactions conducted within that time frame.

The AOV provides a good metric to view the overall growth of your marketplace because it reflects the average transaction value and, like a future value calculator from Omni Calculator, helps predict the associated increase in profit.

More importantly, the AOV provides you with critical insights into the behavior of your customers.

It tells you whether customers are purchasing multiple items, the frequency at which customers buy items, and which items are the most popular on your marketplace.

AOV is important for evaluating your overall pricing strategy, such as how to price your items and what kind of payment methods to offer your customers.

According to Statista, 37% of online shoppers prefer to pay through mobile wallet providers like Apple Pay or Google Pay.

However, your AOV may reveal to you that more customers are buying your items or services using alternative payment methods.

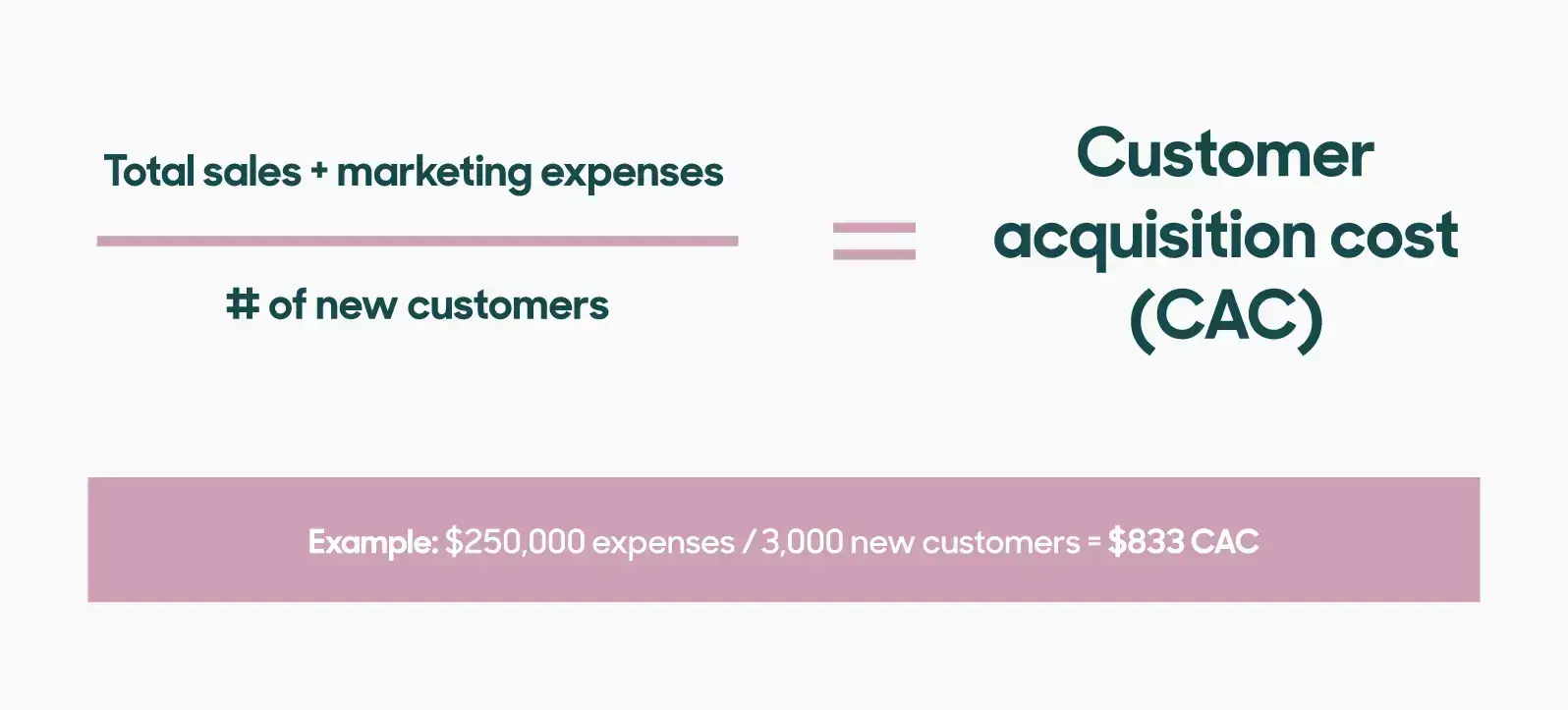

2. CAC (Customer Acquisition Cost)

Source: Zendesk

The CAC, or Customer Acquisition Cost, reveals to you how much you spend (or need to spend) to acquire a new customer. It essentially measures the performance of your business as it relates to making a person a paying customer.

To calculate CAC, take the average total costs associated with new customer acquisition, and then divide by the number of new customers that you have secured over a given time period.

3. Order Fulfillment Rate

Source: Unleashed Software

The fulfillment rate indicates to you how many times your marketplace is delivering the products or services it promises to customers and is expressed as a percentage.

To calculate fulfillment rate, take the number of your orders fulfilled, and then divide by your overall number of orders (including your rejected orders, but not including your canceled orders).

If your fulfillment rate is positive, you should be good. If your rate is negative, however, further investigation will be required in order to identify why it’s happening (such as whether it’s an issue with suppliers or because of issues with the products themselves).

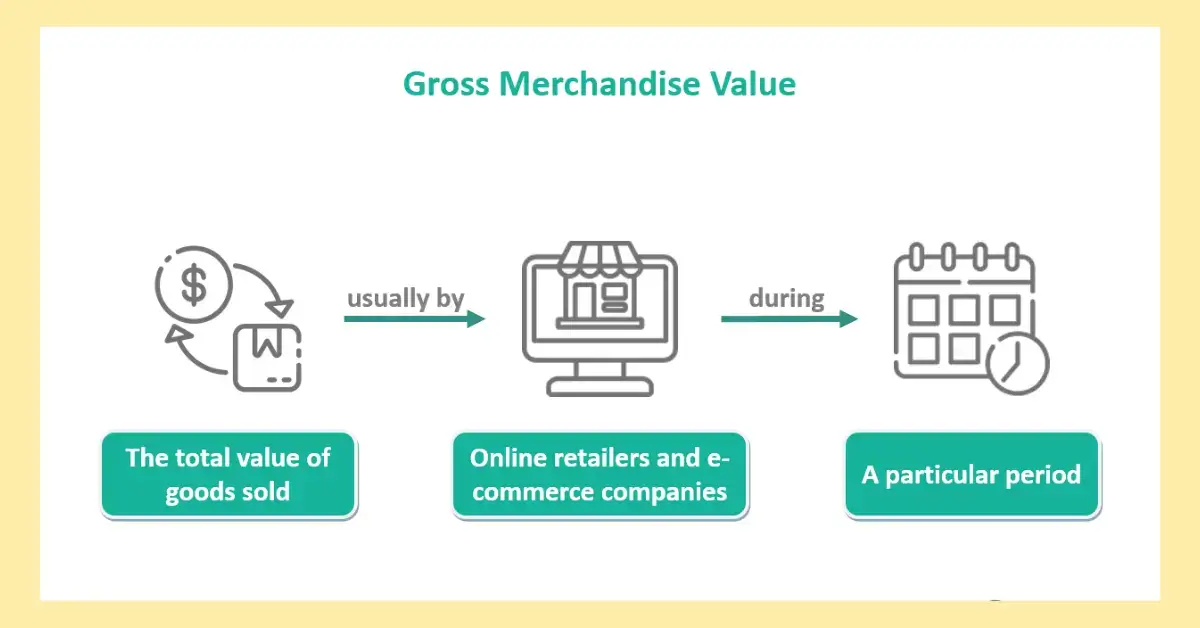

4. GMV (Gross Merchandise Value)

Source: ManifestAI

Your GMV is a reflection of the total value of your orders, measuring the value of your items sold over any given period.

To calculate your GMV, you need to simply calculate the total income that your eCommerce marketplace is receiving, including the seller services, listing fees, and transaction fees.

It’s a good metric for keeping track of the overall efficiency of your marketplace and for breaking down the overall flow of revenue.

There are two areas of revenue to include in your GMV: the first is your transaction and listing fees, and the second is your seller services (including shipping labels, the cost of promoting your listings, and direct checkout costs).

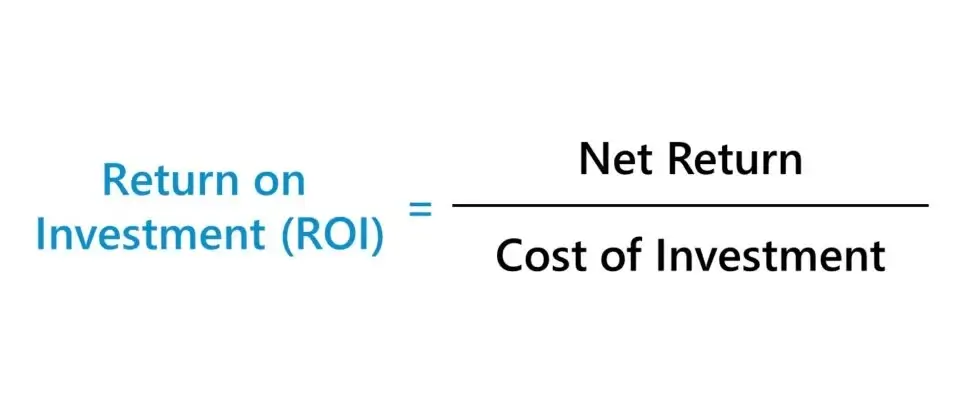

5. ROI (Return on Investment)

Source: WallStreetPrep

ROI is perhaps the most well-known metric for tracking business success, but it’s so important it bears mentioning here again. It’s a simple metric that reveals to you one very crucial aspect of your business: whether or not it’s profitable.

To calculate ROI, you simply need to take your overall profits and subtract the total amount you invested to generate those profits for your first figure.

For your second figure, take your total investment and multiply it by one hundred. Divide your first figure by the second figure for your total ROI.

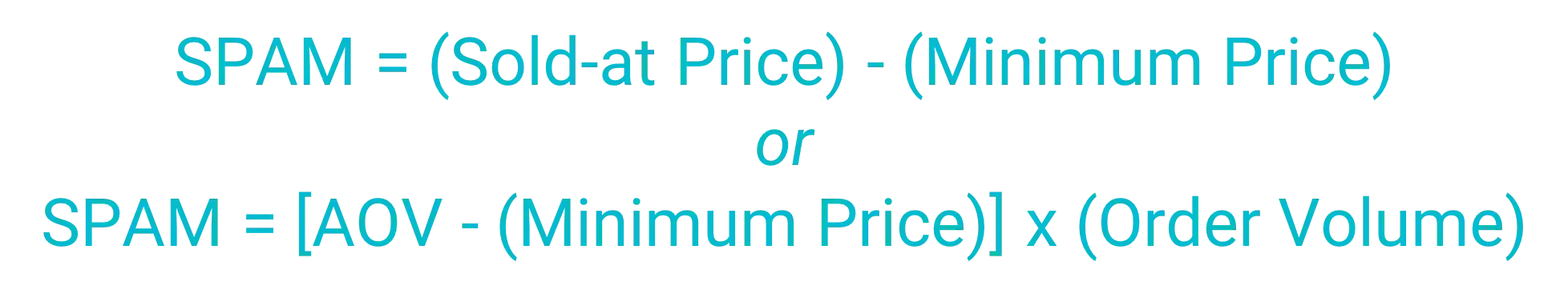

6. SPAM (Sales Price Above Minimum)

Source: Zentail

The SPAM, or Sales Price Above Minimum, reveals how much revenue your business is bringing in, in comparison to the minimum amount you are fine with making.

There are two primary ways to calculate SPAM. The first is used to calculate SPAM for individual items or services. Take the price at which you sold a product or service, and then from that subtract the minimum price you are comfortable with selling it at.

The second method is used to calculate SPAM for large volume orders. Take your AOV (as discussed before) and subtract your minimum comfortable price for the overall order. Take the resulting figure and then multiply it by your overall order volume.

A higher SPAM is good because it tells you that you are bringing in more revenue than you need for any given product or service.

KPIs and Metrics To Set: Quantitative vs. Qualitative

Choosing the KPIs and metrics to analyze comes down to what you feel best reveal insights on qualitative and quantitative growth.

All of the metrics covered in this article fall in the quantitative category. On the other hand, qualitative data keeps track of data expressed by descriptions or categories.

-

Types of Qualitative Data

- Research and observation

- Interviews

- Surveys or questionnaires

- Focus groups, online forums, or communities

- Case studies

This data won’t reveal too much about your actual customers or what they are thinking, but they will reveal to you if your online marketplace is profitable...and specifically which financial goals are being met and which are not.

Conclusion

The above metrics we have covered are not the only metrics that you should keep track of to analyze the overall health of your online marketplace, but they are arguably the most critical ones.